TradersPost vs. CrossTrade Alert Messages: Understanding the Difference

Compare CrossTrade and TradersPost to find the best automated trading solution. We break down features, flexibility, and platform compatibility to help you choose the right fit.

TradersPost and CrossTrade, provide integrations to automate orders from TradingView strategy alerts—but they do so in fundamentally different ways.

In this comprehensive post, we’ll dive deeply into the differences between TradersPost and CrossTrade alert messages, especially focusing on JSON usage, order flexibility, strategy capabilities, and what these differences practically mean for your trading. Let’s unpack everything clearly and thoroughly.

TradersPost and JSON: Structured but Limited

TradersPost utilizes JSON (JavaScript Object Notation) as the core format for processing webhook alerts. JSON is a lightweight, text-based data interchange format designed to be easily readable by humans and machines alike. It provides structured data by organizing key-value pairs clearly.

How TradersPost Uses JSON

TradersPost expects alert messages to be formatted explicitly in JSON, meaning each alert sent to their service must strictly adhere to specific syntax and data structures. For instance, an alert message sent from TradingView via TradersPost might look something like this:

{

"ticker": "{{ticker}}",

"action": "{{strategy.order.action}}",

"quantity": "{{strategy.order.contracts}}",

"order_type": "market",

"take_profit_price": "{{plot("TP")}}",

"stop_loss_price": "{{plot("SL")}}"

}

In this example:

"ticker"specifies the symbol being traded."action"dictates whether you're buying or selling."quantity"indicates the number of contracts."order_type"must be explicitly defined as a market, limit, or another order type."take_profit_price"and"stop_loss_price"require specific price information to be sent directly in the alert, formatted correctly.

While JSON is clean, structured, and predictable, TradersPost requires you to strictly adhere to their prescribed format. However, there are clear limitations with JSON that we will unpack next.

Limitations of JSON-Only Formats

The JSON-only method, while tidy and easy to parse, comes with limitations:

- Rigid Syntax Requirements: Alerts must strictly adhere to the predefined JSON structure. Mistakes, even minor syntax issues, can lead to failed trade executions or missed orders.

- Limited Flexibility: If your trading logic requires customized, conditional, or dynamically calculated alerts, you might encounter limitations with predefined JSON structures. You can’t easily deviate from expected key-value pairs.

- Reduced Strategy Complexity: Because the JSON structure is standardized, traders who utilize nuanced or complex alert logic (such as multi-leg positions, conditional take-profit or stop-loss, or dynamic position sizing calculations) might find JSON's rigidity limiting.

CrossTrade: Breaking Free from JSON Restrictions

CrossTrade takes an entirely different approach. Instead of strictly relying on JSON-formatted alerts, CrossTrade accepts plain-text alert messages directly from platforms like TradingView. This approach empowers traders to design their alerts and orders with total flexibility.

Flexible Alert Formatting with CrossTrade

CrossTrade allows you to define your webhook alerts with far fewer constraints. Here’s an example of how you might structure an alert from TradingView using CrossTrade’s versatile webhook:

key=your-secret-key;

command=PLACE;

account=sim101;

instrument=ES 06-25;

action=BUY;

qty=1;

order_type=MARKET;

tif=DAY;Notice the significant differences here:

- No JSON required: You can simply write the alert as human-readable plain text.

- Custom Fields: You're free to define fields like

TakeProfit,StopLoss, and more, dynamically using percentage or absolute values as you see fit. - Flexible Order Types: Quickly and easily specify limit orders, market orders, and bracket orders directly within the alert text.

You could easily send:

A quick close position order with a single alert:

key=your-secret-key;

command=CLOSEPOSITION;

account=sim101;

instrument=ES 06-25;A market order with tick-based Take Profit (TP) and Stop Loss (SL):

key=your-secret-key;

command=PLACE;

account=sim101;

instrument=ES 06-25;

action=BUY;

qty=1;

order_type=MARKET;

tif=DAY;

take_profit=100 ticks;

stop_loss=-50 ticks;A dynamic strategy based entry:

key=your-secret-key;

command=PLACE;

account=sim101;

instrument=ES 06-25;

action={{strategy.order.action}};

qty={{strategy.order.contracts}};

order_type=MARKET;

tif=DAY;

The key takeaway: with CrossTrade, you aren't limited to structured JSON. Your alert messages are entirely customizable based on your strategy logic, risk management preferences, and trading style.

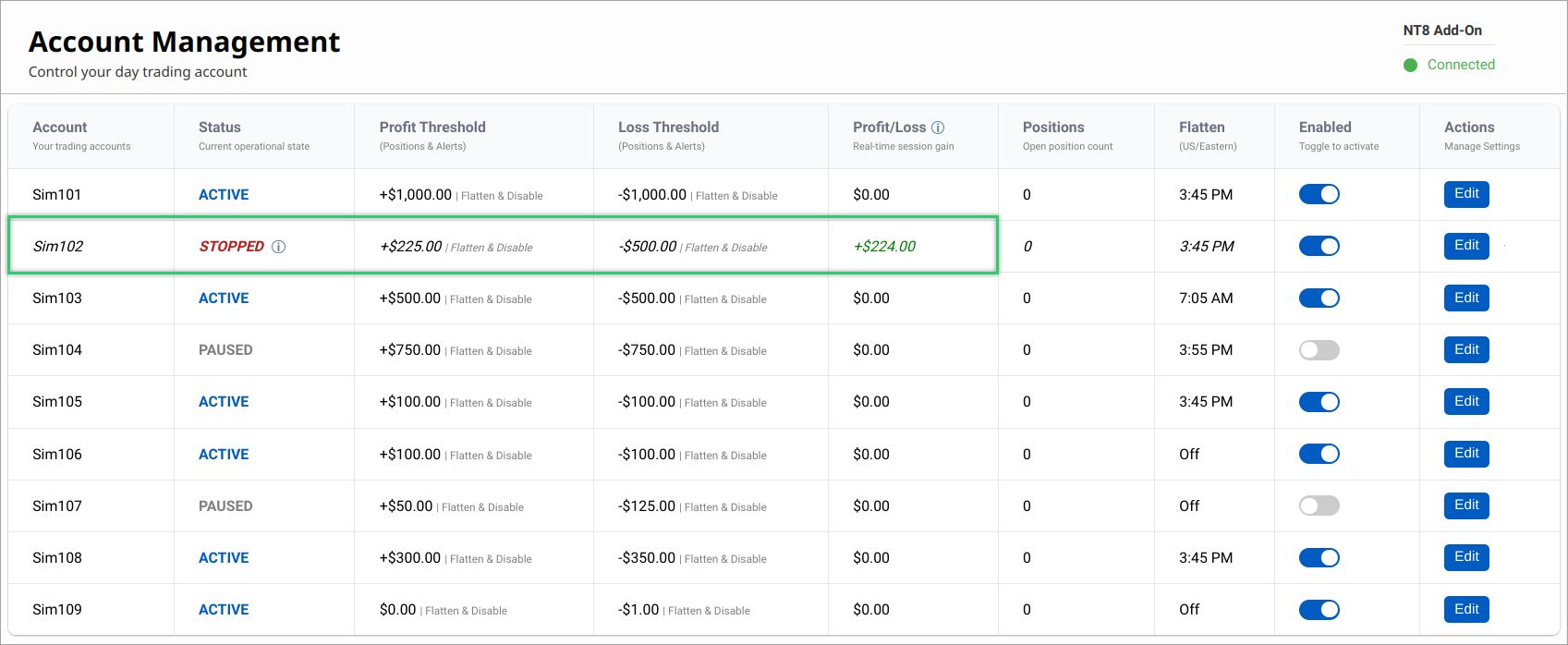

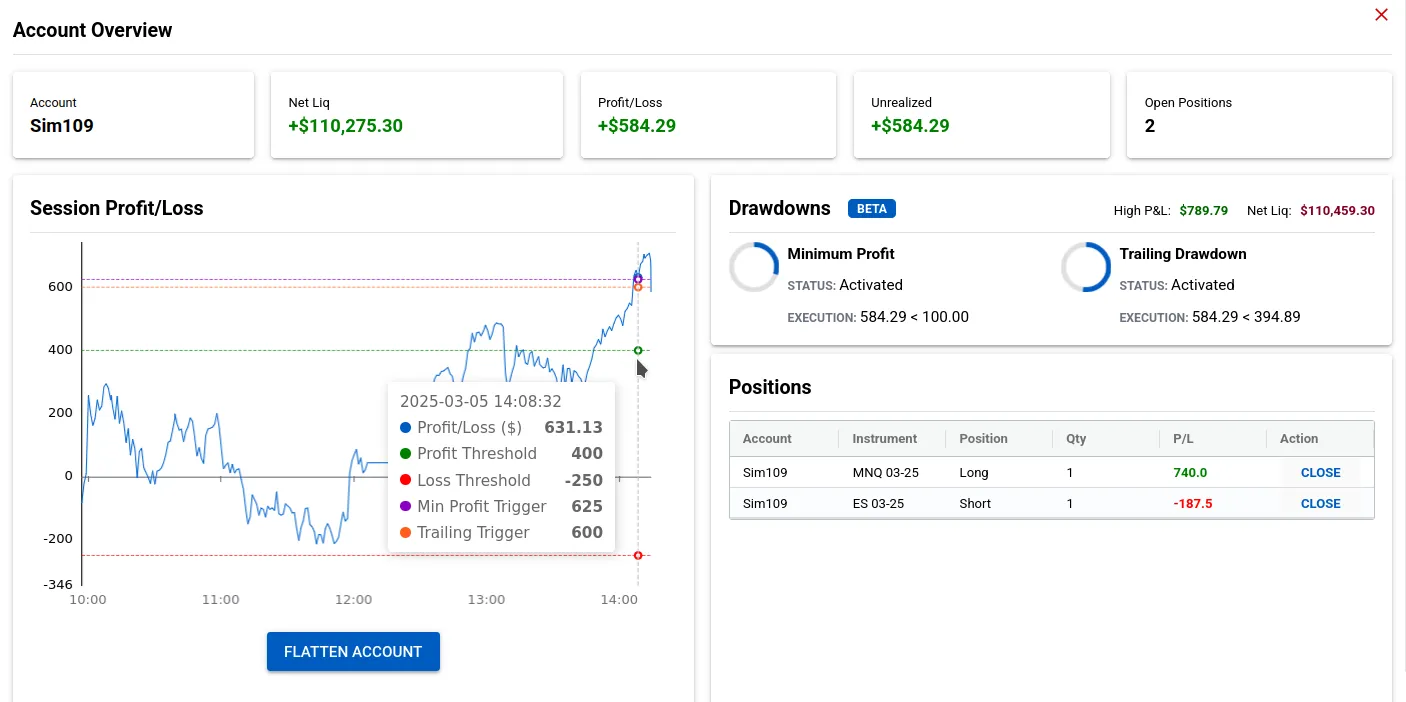

Advanced Monitoring and Risk Management with CrossTrade Pro

Another area where CrossTrade stands out significantly is its advanced monitoring features. Traders seeking more robust automation capabilities often need sophisticated risk management features, like automatic flattening or trailing profit and loss thresholds.

CrossTrade Pro offers exactly this. For instance, you can:

- Automatically flatten positions and disable further trading once your daily profit or loss thresholds are reached.

- Set dynamic thresholds to manage your account exposure automatically throughout the trading day.

This simple, human-readable alert instructs CrossTrade Pro to actively monitor your account’s Daily P&L. It will automatically flatten all positions and prevent further orders if your profit reaches $1,000 or your losses hit -$500 in a day, protecting your capital automatically.

Speed is King

It's simple, when getting alerts from A to B using any bridge or middleware software, speed is paramount. On average, CrossTrade is processing alerts in around 30 milliseconds, which is the fastest solution on the market.

Traders everywhere recognize this...

Practical Example: Comparing a Simple Alert in TradersPost vs. CrossTrade

Let’s put theory into practice. Imagine you're setting up an alert from a TradingView strategy that needs to send a market order with built-in take profit and stop loss orders:

- TradersPost JSON example:

{

"ticker": "NQ",

"action": "buy",

"quantity": 1,

"order_type": "market",

"take_profit_price": 16000,

"stop_loss_price": 15900

}

In TradersPost, your JSON must explicitly state each parameter in structured JSON format.

- CrossTrade simplified example:

key=your-secret-key;

command=PLACE;

account=sim101;

instrument=ES 06-25;

action={{strategy.order.action}};

qty={{strategy.order.contracts}};

order_type=MARKET;

tif=DAY;

In CrossTrade, you simply tell the system exactly what you want in plain language—no JSON required, with flexibility in specifying relative percentages or absolute values as needed.

Getting Started with CrossTrade is Simple

Setting up CrossTrade is straightforward and thoroughly documented:

- CrossTrade Setup Guide helps you easily integrate your trading platform and strategies.

- Webhook Formatting Documentation explains exactly how to structure alerts to fit your precise needs, highlighting the remarkable flexibility CrossTrade provides.

Conclusion: Choosing the Right Fit for Your Trading

Both TradersPost and CrossTrade enable automated trade execution, but their methods differ significantly. While TradersPost enforces a structured JSON approach that's predictable but limiting, CrossTrade offers unmatched flexibility with human-readable alert messages that process at top-tier speed.

CrossTrade is built for flexibility and versatility—ultimately enabling smarter, more adaptable automated trading strategies that grow and scale alongside your evolving trading style.

Ready to experience CrossTrade’s flexibility for yourself?