An Introduction to Futures Trading: What You Need to Know

Futures trading is a powerful way to access global markets, offering traders opportunities in stocks, commodities, currencies, and more. This guide explores the fundamentals of futures, the history behind these financial instruments, and the tools needed to trade effectively.

Futures trading is a cornerstone of the financial markets, enabling traders and investors to speculate on price movements, hedge risks, and gain exposure to various asset classes. While futures have been around for centuries, their role in today’s markets has evolved with the advent of electronic trading platforms like NinjaTrader and exchanges such as the Chicago Mercantile Exchange (CME).

In this guide, we’ll explore what futures contracts are, their history, how they function, and key considerations for traders looking to get started.

What Are Futures?

Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a specified date in the future. These contracts are traded on centralized exchanges like the CME and span various asset classes, including:

- Equities (Stock Index Futures) – e.g., E-mini S&P 500 (ES), Nasdaq 100 (NQ)

- Commodities – e.g., Crude Oil (CL), Corn (ZC)

- Metals – e.g., Gold (GC) Silver (SI)

- Interest Rates – e.g., U.S. Treasury Bonds (ZB), Eurodollar Futures

- Cryptocurrencies – e.g., Bitcoin Futures (BTC)

Futures trading provides leverage, allowing traders to control large contract sizes with a fraction of the capital required in traditional markets. However, this leverage increases both potential profits and risks.

A Brief History of Futures Trading

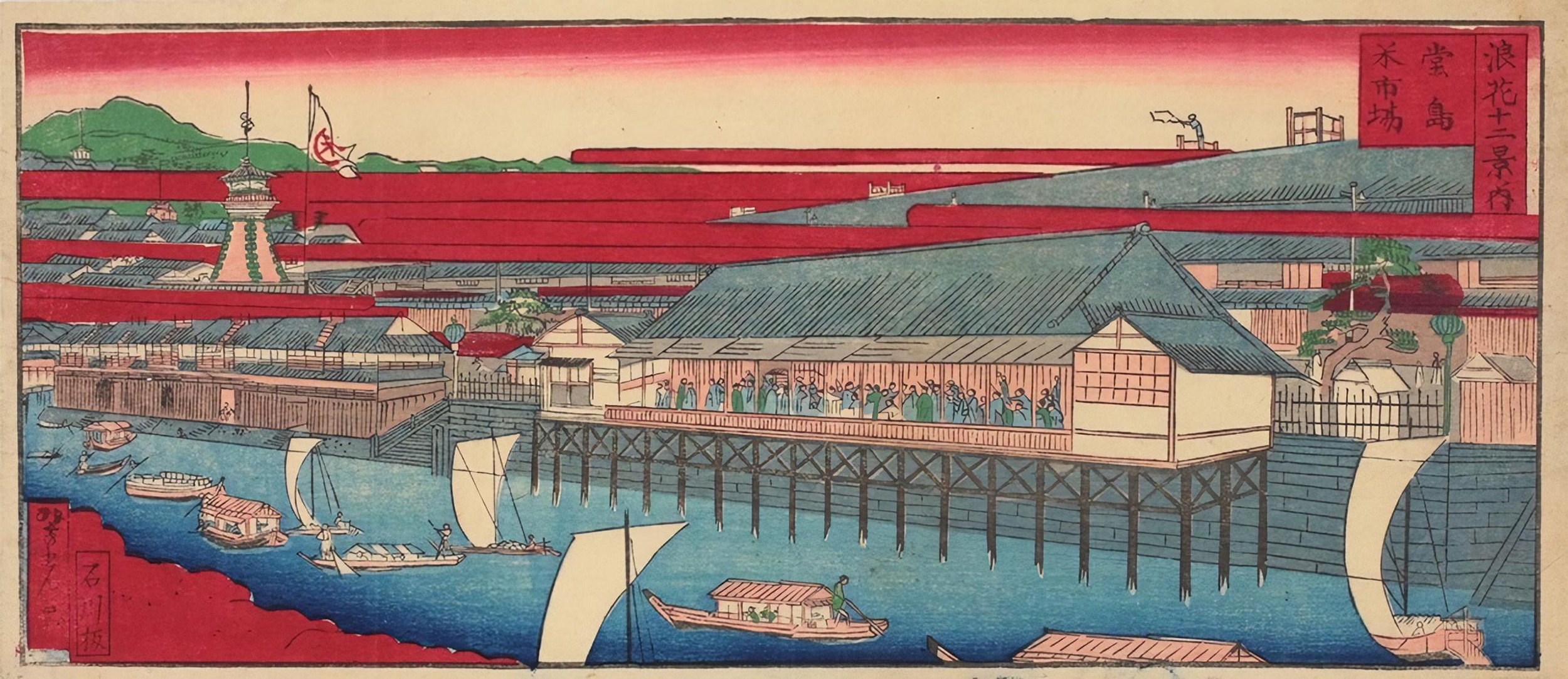

Ancient Beginnings: Agricultural Roots

The concept of futures contracts dates back to ancient times. In Japan during the 17th century, rice traders developed forward contracts to stabilize rice prices. This system evolved into the Dojima Rice Exchange, often regarded as the world’s first formal futures market.

19th Century: The Birth of Modern Futures

The Chicago Board of Trade (CBOT) was established in 1848 to facilitate grain trading, helping farmers and merchants hedge against price volatility. By 1877, standardized futures contracts became common, making it easier to trade agricultural products like corn and wheat.

20th Century: Expansion Beyond Agriculture

By the 1970s, futures trading expanded beyond commodities into financial instruments such as stock indexes, bonds, and currencies. The Chicago Mercantile Exchange (CME) introduced the first financial futures contract in 1972, allowing traders to speculate on currency fluctuations.

Today: The Digital Revolution

Modern futures trading is electronic, with platforms like NinjaTrader providing retail traders access to professional-grade tools for charting, strategy automation, and execution.

How Futures Trading Works

Each futures contract is designed with a set of standardized specifications that dictate how the contract is traded. Understanding these details is critical for managing risk, calculating position size, and executing trades efficiently.

Key Elements of a Futures Contract

Every futures contract traded on an exchange like the CME Group follows a specific structure, including:

Contract Size

- The contract size defines the quantity of the underlying asset represented by one futures contract.

- This varies across different markets:

- E-mini S&P 500 (ES) → 50 times the S&P 500 Index value.

- Crude Oil (CL) → 1,000 barrels of oil per contract.

- Gold (GC) → 100 troy ounces per contract.

- Corn (ZC) → 5,000 bushels per contract.

Tick Size & Tick Value

- Futures prices move in increments called “ticks.”

- The tick size is the minimum price fluctuation for that contract.

- Each tick corresponds to a specific monetary value, which impacts profit and loss calculations.

Example Tick Sizes & Values:

| Futures Contract | Tick Size | Tick Value |

|---|---|---|

| E-mini S&P 500 (ES) | 0.25 points | $12.50 per tick |

| Nasdaq 100 (NQ) | 0.25 points | $5 per tick |

| Crude Oil (CL) | 0.01 points | $10 per tick |

| Gold (GC) | 0.10 points | $10 per tick |

Contract Expiration & Rollover

- Unlike stocks, futures contracts have expiration dates because they are agreements to buy or sell an asset at a future date.

- Traders typically do not hold contracts until expiration unless they want physical delivery (commodities) or settlement (financial futures).

- Instead, traders “roll” their positions into the next contract before expiration.

Key Futures Expiration Details:

- Stock Index Futures (ES, NQ, YM, RTY) → Quarterly expirations (March, June, September, December).

- Crude Oil Futures (CL) → Monthly expirations.

- Metals & Agricultural Futures → Vary by contract; some expire every few months.

Margin Requirements (Initial & Maintenance Margin)

- Margin in futures is different from stock trading. Instead of borrowing money, margin represents a good faith deposit required to trade.

- Two types of margin:

- Initial Margin – The amount required to open a position.

- Maintenance Margin – The minimum balance needed to keep the position open.

Example of CME Margin Requirements (Approximate as of 2024):

| Futures Contract | Initial Margin | Maintenance Margin |

|---|---|---|

| E-mini S&P 500 (ES) | $12,000 | $10,000 |

| Nasdaq 100 (NQ) | $16,500 | $13,500 |

| Crude Oil (CL) | $6,500 | $5,500 |

Intraday Margin:

Some brokers (like NinjaTrader) offer lower intraday margin, allowing traders to control contracts for much less than the full initial margin.

Futures Market Sessions Overview

Futures markets operate nearly 24 hours a day, five days a week, divided into distinct trading sessions that correspond to major global financial centers. The electronic trading day begins with the Asian session (also called the Globex evening session in the U.S.), followed by the European session, and then the U.S. session which sees the highest volume and liquidity.

Each session has its own open and close times, with brief maintenance windows where trading halts. The U.S. equity index futures (ES, NQ, YM) and many other contracts trade on CME Globex from Sunday evening through Friday afternoon, with a daily trading halt from 4:15 PM to 4:30 PM CT for settlements.

Understanding these sessions is crucial for futures traders because liquidity, volatility, and price action characteristics vary significantly depending on which major markets are active—the London open at 3:00 AM ET and New York open at 9:30 AM ET typically generate the most significant price movements.

Futures Trading Sessions

| Session | Market | Open (ET) | Close (ET) | Characteristics |

|---|---|---|---|---|

| Asian Session | Sydney, Tokyo, Hong Kong | 6:00 PM | 2:00 AM | Lower volume, range-bound, responds to Asian economic data |

| European Session | London, Frankfurt | 2:00 AM | 11:00 AM | Increased volatility, London open at 3:00 AM ET is significant |

| U.S. Session | New York, Chicago | 8:00 AM | 4:15 PM | Highest volume and liquidity, most volatile 9:30 AM - 4:00 PM |

| Overnight/Globex | Electronic trading | 6:00 PM Sun | 5:00 PM Fri | Near 24-hour trading with 15-min halt at 4:15-4:30 PM CT daily |

Note: Times shown are for CME equity index futures (ES, NQ, YM). Specific contracts may have different hours. All times subject to exchange rules and holiday schedules.

Why Trade Futures?

✅ Leverage: Control large positions with less capital compared to stocks.

✅ Liquidity: Major futures contracts have deep liquidity, ensuring smooth trade execution.

✅ Extended Trading Hours: Unlike stocks, futures trade nearly 24 hours a day.

✅ Diverse Markets: Access to equities, commodities, currencies, and bonds from one account.

✅ Short Selling Ease: No restrictions like in the stock market—futures allow seamless shorting.

Common Pitfalls to Avoid

⚠️ Overleveraging: Trading too large can lead to significant losses.

⚠️ Ignoring Market Fundamentals: News events and reports (e.g., Fed meetings, CPI data) impact futures prices.

⚠️ Emotional Trading: Avoid revenge trading and stick to your risk management rules.

⚠️ Not Accounting for Overnight Risks: Holding positions overnight exposes you to unexpected market moves.

Must-Read Books on Futures Trading

If you want to level up your knowledge, these books offer a mix of fundamentals, strategies, and psychological insights.

📖 "A Trader’s First Book on Commodities" – Carley Garner

- A perfect introduction to futures and commodity trading.

📖 "Trading in the Zone" – Mark Douglas

- Focuses on trading psychology and developing a professional mindset.

📖 "The New Trading for a Living" – Dr. Alexander Elder

- Covers technical analysis, trading psychology, and risk management.

📖 "Mastering the Trade" – John F. Carter

- Detailed futures trading strategies, including momentum and VWAP setups.

📖 "The New Market Wizards" – Jack Schwager

- Conversational interviews with top traders or 'Market Wizards' that aim to shed light and provide key insights.

Best Educational Websites for Futures Trading

These websites offer valuable free and premium educational content for traders of all levels.

🔗 CME Group – Futures Contracts & Education

- Detailed contract specifications, margin requirements, and futures expiration calendars.

- Free educational courses & webinars on futures trading.

🔗 NinjaTrader Blog – Futures Trading & Strategies

- Offers video tutorials on NinjaTrader, order flow, and automated trading strategies.

- Regular market analysis and trade ideas for futures traders.

🔗 Investopedia – Futures Trading Section

- Covers basic futures concepts, margin requirements, and trading strategies.

- Explains economic events that affect futures markets (like FOMC, CPI, and Non-Farm Payroll).

🔗 TradingView – Futures Analysis & Charting

- Free charting platform with advanced futures indicators, drawing tools, and strategies written in Pine Script.

- Access to community-driven ideas and strategies shared by experienced traders.

🔗 TopStep - Trading Combine

- Offers a simulated trading challenge where traders can earn a funded account.

- Focuses on risk management and consistency in futures trading.

Wrapping Up

Futures trading is a dynamic and exciting way to participate in the financial markets, offering unique advantages over traditional stock trading. Whether you are looking to hedge risk, speculate on price movements, or trade global commodities, understanding the mechanics of futures is essential for long-term success.

As the industry evolves, modern web-based trading platforms like TradingView are becoming more and more popular. CrossTrade is helping to connect modern web based applications to desktop-based platforms like NinjaTrader 8.

With platforms like NinjaTrader and exchanges such as the CME, traders have access to powerful tools and a vast range of markets. By focusing on risk management, strategy development, and continuous learning, you can build a strong foundation in futures trading.