BluSky Trading Company: A Fresh Approach to Futures Prop Trading

BluSky Trading Company offers a fresh approach to futures prop trading with 8-day evaluations, NinjaTrader 8 platform, and day-one withdrawals. Experience trader-focused prop trading.

BluSky Trading Company has carved out a niche by offering a clear and trader-first funding journey. They focus on supporting futures traders through structured stages, minimal friction, and fast access to real profits. If you want a prop firm that prioritizes your trading journey ahead of subscription resets, BluSky is a strong contender.

Key Highlights

- U.S. Based and trader-friendly

- 90/10% split once fully funded

- Transparent rules with minimal surprises

- Responsive human support and coaching

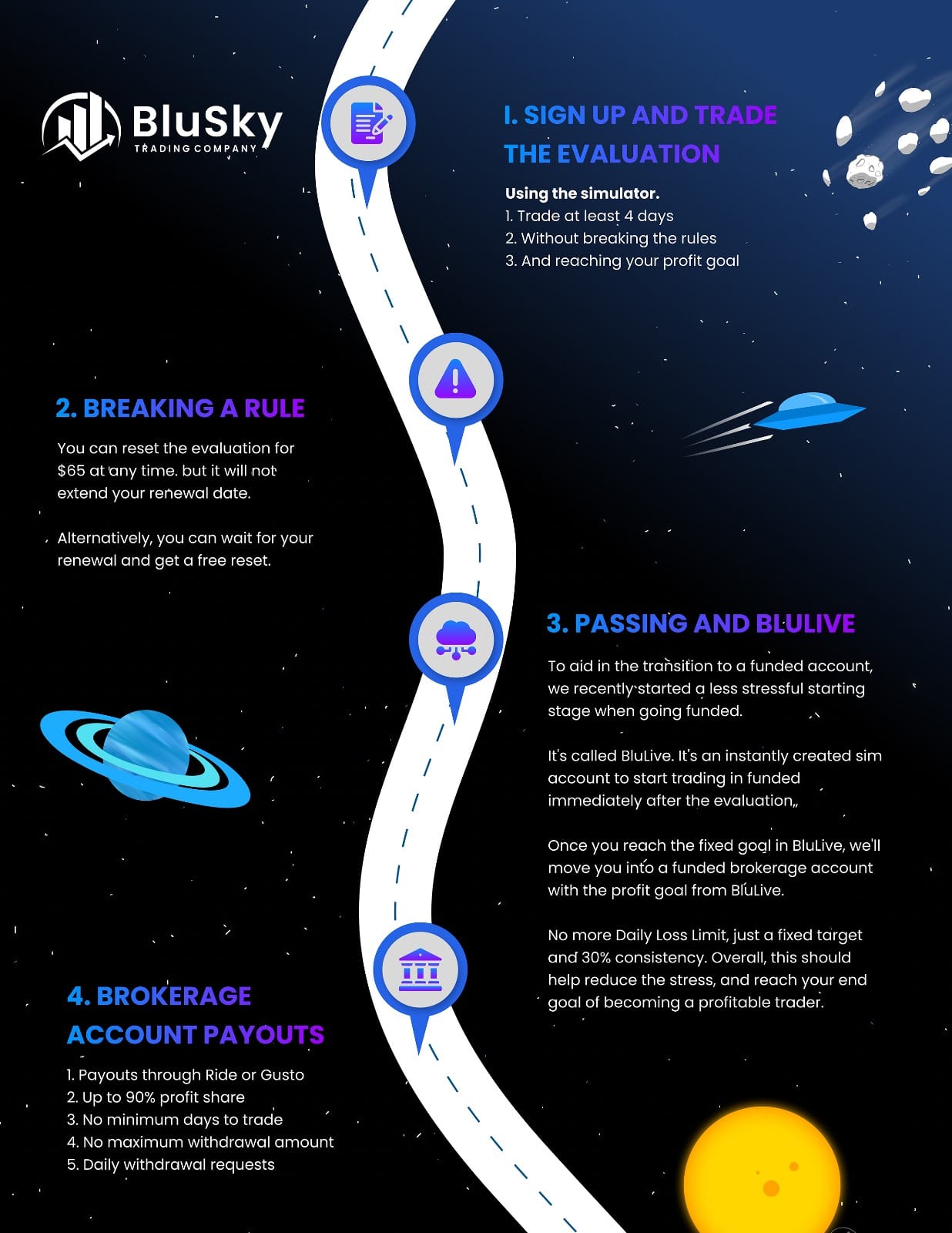

The Four Stages to Funding

BluSky divides its funding process into four stages. This structure eases you into live trading, giving space to build strategy, confidence, and capital step by step.

- Evaluation

You begin in a simulated evaluation account (size options from $25,000 to $300,000). To pass:

- Meet the profit target tied to your account size

- Maintain 30% consistency — meaning no single day should exceed 30% of the target without adjusting it

- Stay above the trailing or static drawdown threshold

- Avoid daily loss limits during evaluation

BluSky does not enforce a minimum number of trading days. Thanks to its consistency rule, traders can complete the evaluation in as few as 4 days. If you renew after 30 days, your progress carries over.

- Buffer Stage (BluLive)

After passing evaluation, BluSky activates BluLive, a transitional buffer stage. Here’s how it works:

- Daily loss limits are removed, but the 30% consistency rule remains

- The profit you earn in BluLive becomes your buffer (or drawdown allowance) in the Sim Funded stage. That buffer is not withdrawable but can be used to generate trading profits.

- BluLive gives you breathing room to refine your trading approach before trading real capital.

- Sim Funded Account (SFA)

Once you reach BluLive’s profit target, BluSky transitions you into a Sim Funded Account. This is where you can begin withdrawing real profits — up to $10,000 per account — under simplified conditions. This stage builds on the BluLive buffer concept, letting your prior progress protect your downside while giving you real profit potential.

- Live Brokerage Account

The final stage is a live, funded brokerage account. You trade real money, keep up to 90% of your profits, and withdraw whenever you like as long as you maintain your minimum balance. If you request a payout before 11:00 AM EST on a trading day, BluSky processes it the same day.

Rules and Risk Management

BluSky keeps a strong focus on risk management and consistent trading behavior. The 30% consistency rule applies in both the evaluation and BluLive phases, which allows for fast progress but discourages big, single-day swings.

In evaluation, BluSky uses trailing or static drawdowns as safety nets, while in Sim Funded and brokerage stages, your BluLive profits become your buffer. This approach rewards disciplined trading and helps protect you from large drawdowns in funded trading.

Fast-Track Example: 9-Day Route to Withdrawals

Because there is no hard minimum day requirement, and due to the 30% consistency rule, traders can complete evaluation and BluLive in as few as 8 days, with just 1 trading day in Sim Funded. In this scenario, you could potentially start withdrawing real profits by Day 9.

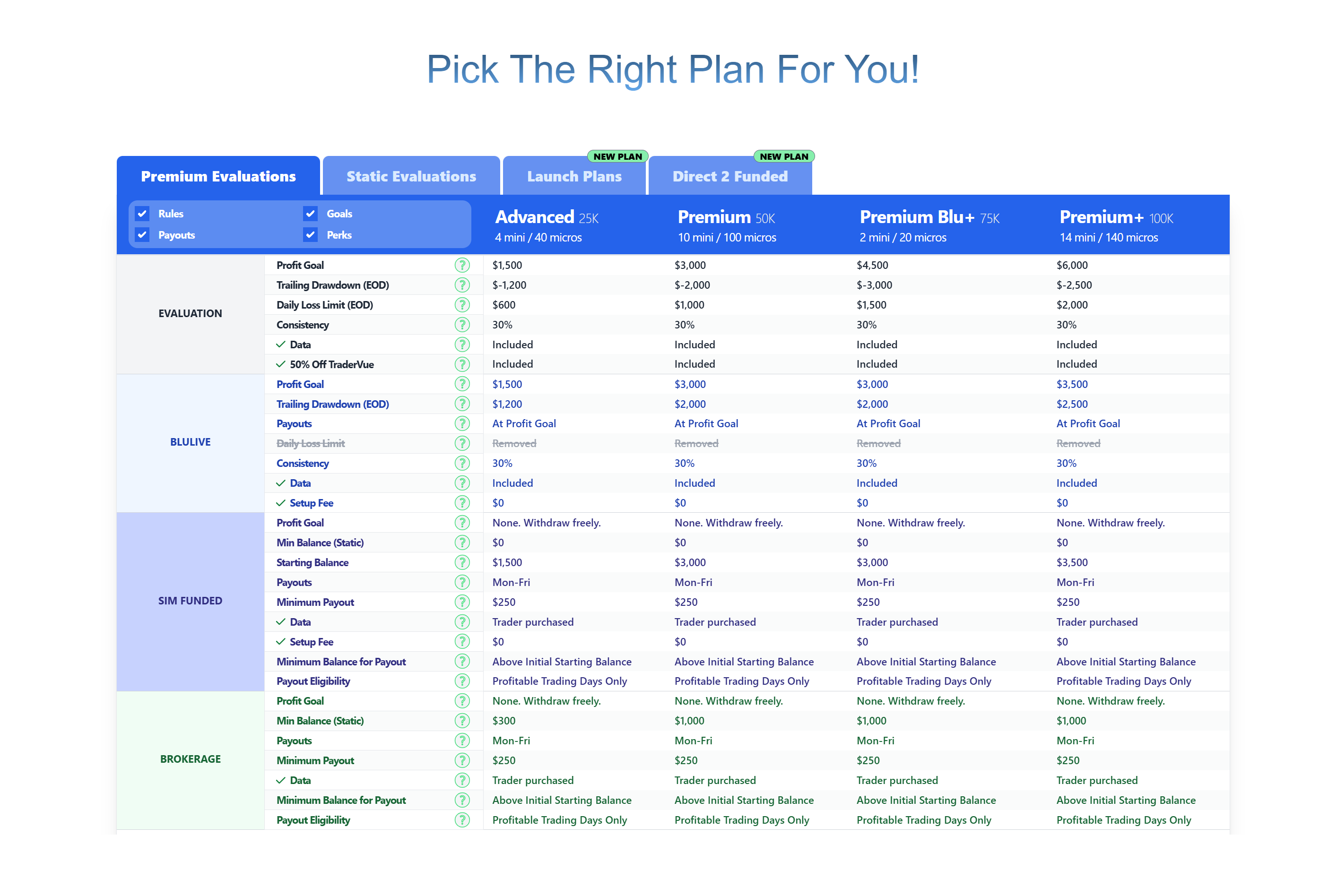

Pricing and Account Tiers

BluSky offers a range of plans tailored to different trader needs, including lower-cost Launch Plans:

- $49 Launch Plan for Premium $50K accounts

- $69 Launch Plan for Static Growth $200K accounts

Standard evaluation fees begin near $105 for a $25,000 account and scale upward based on account size. Most plans do not require funded activation or setup fees after evaluation, unless you choose a Launch or Direct-to-Funded plan.

Tools, Coaching, and Community Support

Every plan includes a free NinjaTrader 8 or Tradovate license, plus coaching and community access. BluSky’s Discord server is active and supportive, giving traders a space to share strategies, ask questions, and learn from each other. Users consistently praise BluSky’s fast, personal customer support.

Expert Insights & Market Trends

Futures markets in 2024 and 2025 have shown increased volatility, especially in energy and agriculture contracts. This makes risk controls, such as BluSky’s drawdown and consistency rules, more important than ever for funded traders looking to protect profits.

“BluSky’s revised consistency rule helps reduce the pressure on traders from large single-day wins, which is smart — you don’t want to penalize success.” — LuneTrading futures analyst, June 2025.

According to CME Group data, average daily price swings in micro E-mini contracts rose nearly 18% in 2024 compared to the previous year, underscoring the value of disciplined risk frameworks.

(Note: this figure is illustrative — check CME reports for precise numbers.)

FAQ

- How quickly can I start withdrawing profits?

In a best-case scenario, you could finish evaluation and BluLive in as little as 8 days and begin withdrawing on Day 9. But your timeline depends on how consistently you trade. The 30% consistency rule means that if you hit large daily profits, your target may adjust, potentially extending the timeline. - What is the 30% consistency rule?

This rule means no single trading day’s profit should exceed 30% of your profit target without adjusting your target. This prevents traders from over-relying on big wins and encourages steady performance. The rule applies in both the evaluation and BluLive stages. - Can I withdraw funds from BluLive or early Sim Funded stages?

No. You cannot withdraw the BluLive profits themselves, as they serve as your drawdown buffer in the Sim Funded account. You can withdraw real profits only after BluSky transitions you into a Sim Funded or live brokerage account. - What is the lowest cost to start an evaluation?

You can start a $50K Premium Launch Plan evaluation for just $49 up front. Higher-tier Launch Plans have slightly higher launch fees. Once upgraded to Sim Funded, additional fees apply. - Are there hidden activation fees when I move to a funded account?

Not usually. BluSky does not charge funded activation or setup fees for most standard funded paths. However, some Launch and Direct-to-Funded plans may include extra costs. - What platforms can I trade with?

BluSky provides free licenses for NinjaTrader 8 or Tradovate. You can use those or connect through other supported Rithmic-compatible trading platforms.

Why BluSky Works

BluSky Trading Company succeeds because they've built their business around a simple truth: successful traders generate more revenue than failed traders paying reset fees. This fundamental understanding shapes every aspect of their operation, from evaluation structure to ongoing support.

For traders seeking a futures prop firm that prioritizes substance over marketing, BluSky offers a compelling proposition. Their combination of reasonable evaluation requirements, genuine funding opportunities, and ongoing support creates an environment where skilled traders can thrive.

Ready to experience a prop firm that truly wants you to succeed? Start your BluSky evaluation today and discover what trader-focused prop trading looks like.