Sneak Peek: CrossTrade Trade Copier for NinjaTrader 8

Let's break down the all new Trade Copier and cover all of its features in this sneak peak guide.

We're excited to give you an exclusive first look at what we've been building. The CrossTrade Trade Copier is nearly ready for release, and today we're walking through its key features so you can see exactly what's coming.

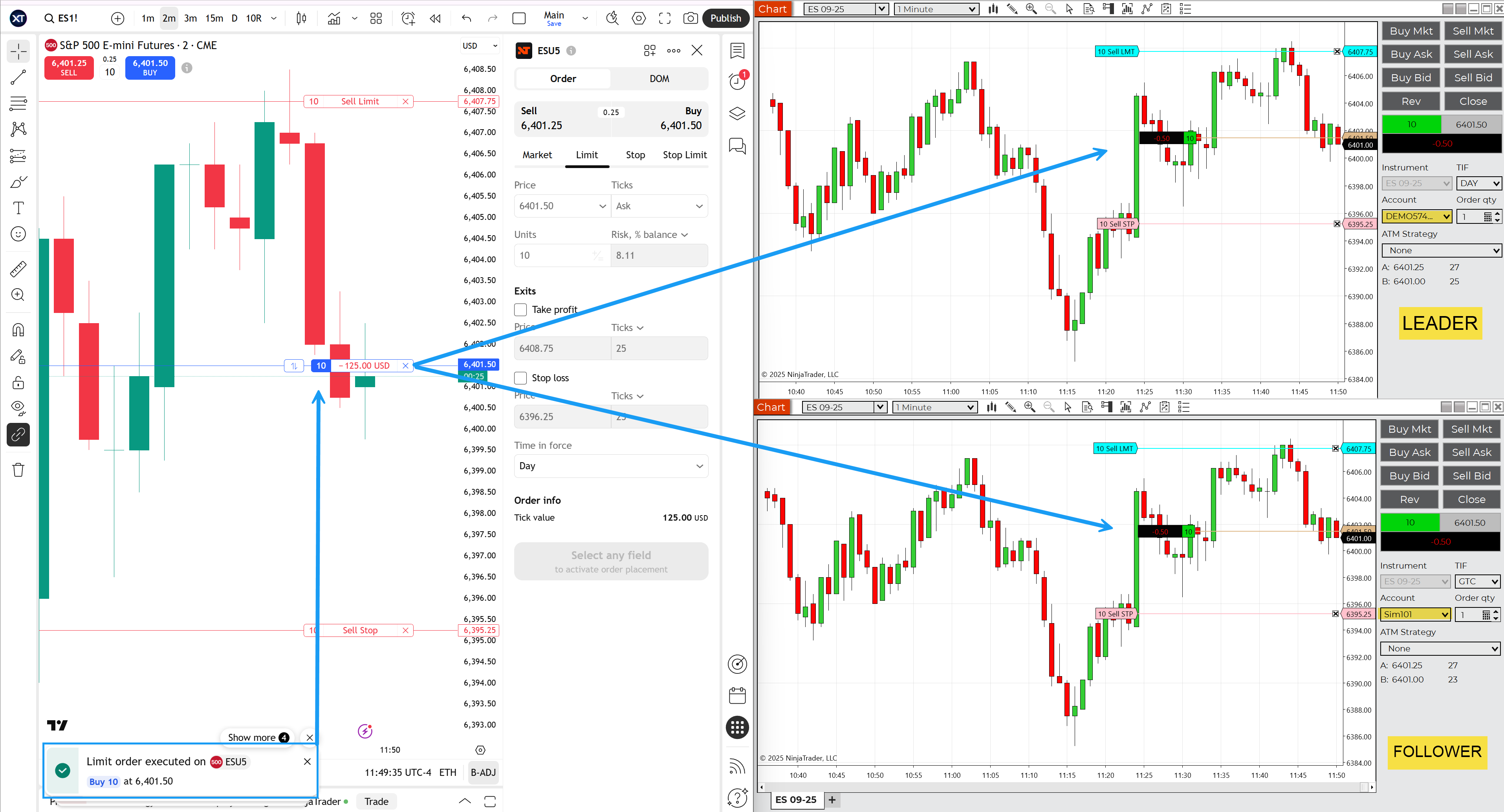

It is now possible to trade manually from TradingView to NT8 Desktop by executing into an NT/Tradovate live or demo account and copy trade to wherever you want.

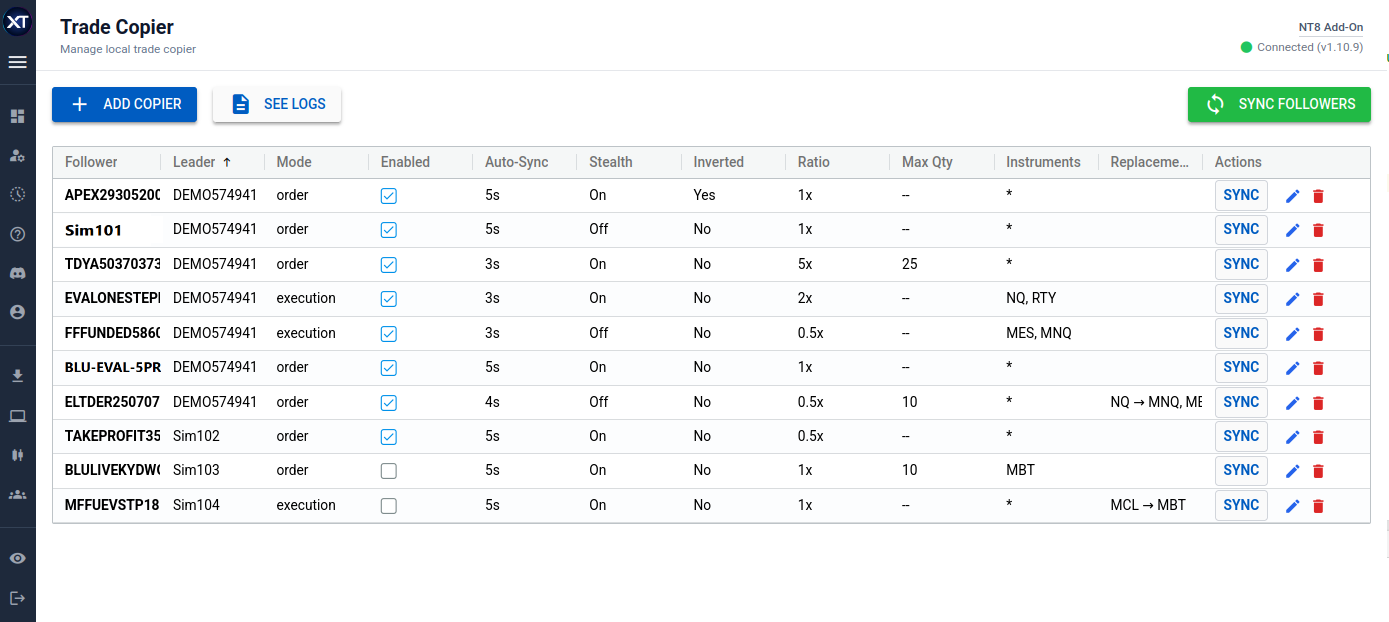

Create as many trade copiers as you want between live, demo, sim, and prop accounts, and keep it all synchronized with the game-changing Auto-Sync.

Setting Up Your First Copy Relationship

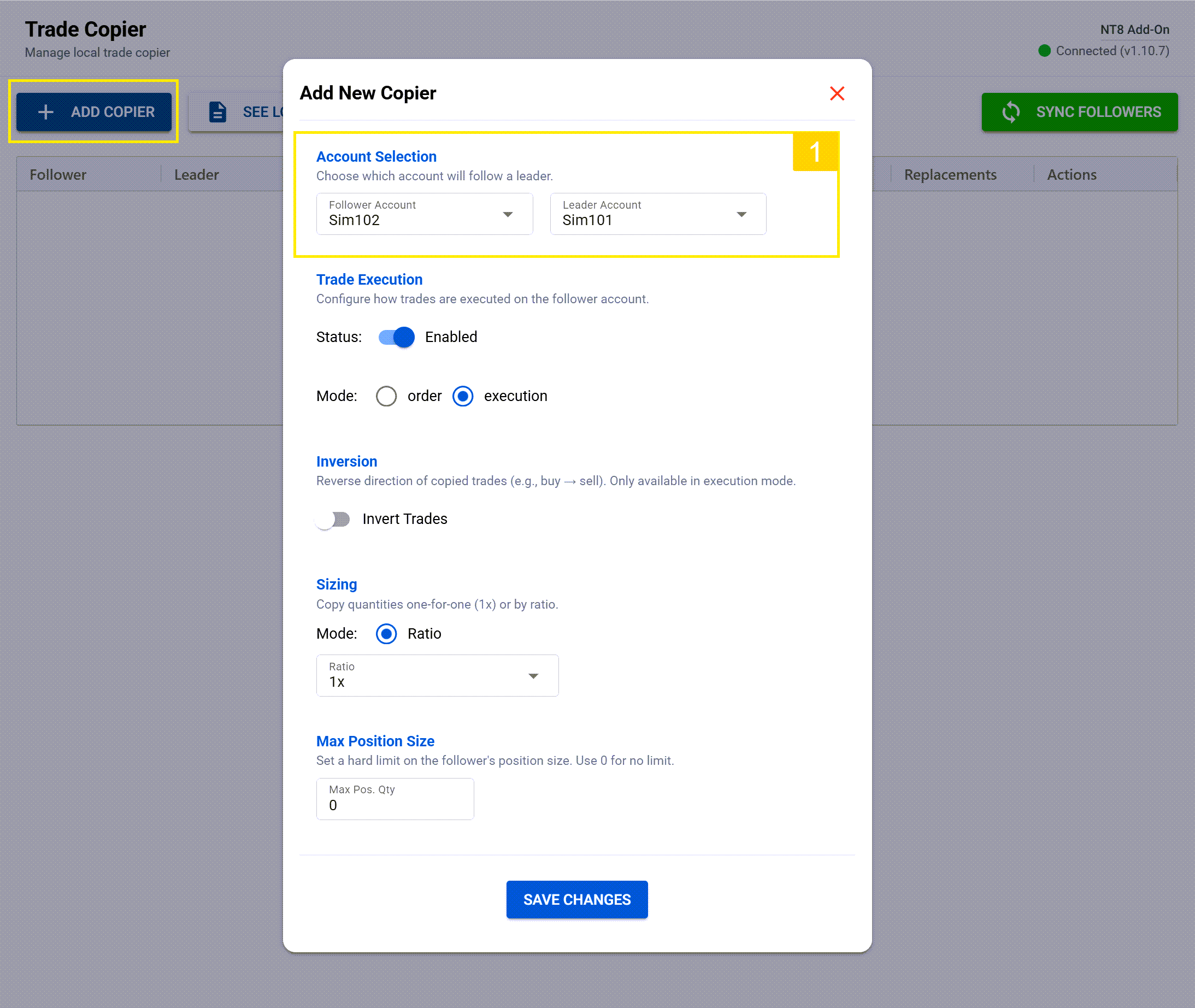

Here in the Trade Copier interface, you have three primary buttons: Add Copier, See Logs, and Sync Followers for manual syncing. We'll cover more about the last two in a minute, for now lets start create our first copier.

I'm going to set up a basic copy relationship between two accounts. First, click here to Add Copier, then you select the account you want to be the Follower. In this example, I am using Sim102 as the follower and I want it to copy trades from my Leader account, Sim101. The account type doesn't matter, any NT8 account can be used for the leader or the follower.

This is what we call multi-directional copying.

Unlike traditional copiers that force you into rigid leader-follower setups, our system lets any account follow any other account. I can set up Account A to follow Account B, Account B to follow Account C, and Account C to follow Account D, all at the same time.

This creates incredibly flexible copying networks. Maybe you want your main strategy copying to multiple prop accounts, while also having those prop accounts copy specific setups back to a master hedging account. With our multi-directional approach, you can build whatever copying architecture makes sense for your trading.

Now that we have two accounts established for a copying relationship, let's dive into the real power of this system, one feature at a time.

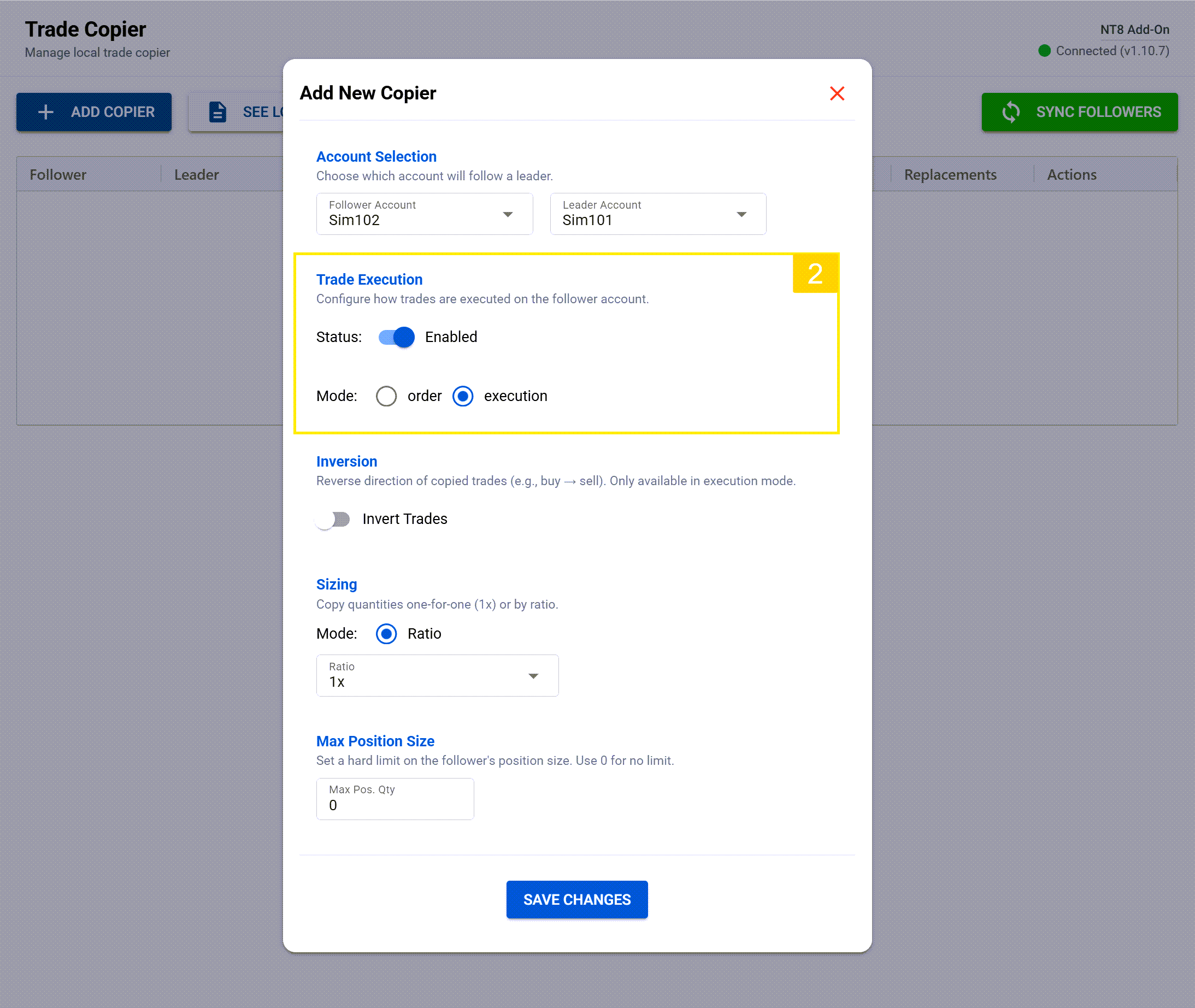

Trade Execution: Status and Mode

Status: Simple and straightforward... toggle on to copy, toggle off to stop copying. If you toggle the copier off, then you'll see a log entry indicating the config change.

Order Mode vs. Execution Mode

We've built two distinct copying modes to match different trading styles. Let me show you the difference.

First, Order Mode—this is ultra-precise synchronization. Every limit order, every stop, every bracket setup gets replicated exactly. If I modify the order, cancel it, or change the stop loss, the follower account mirrors every action in real-time.

Now let me switch this relationship to Execution Mode. In this mode, we focus on actual trade executions rather than pending orders. When the source account gets filled, the follower immediately executes a market order to match that position. This is perfect for fast-moving strategies where you care more about getting the fill than replicating the exact order management.

You can mix and match these modes across different copy relationships, so maybe your main strategy uses Order Mode for precise replication, while your scalping account uses Execution Mode for speed.

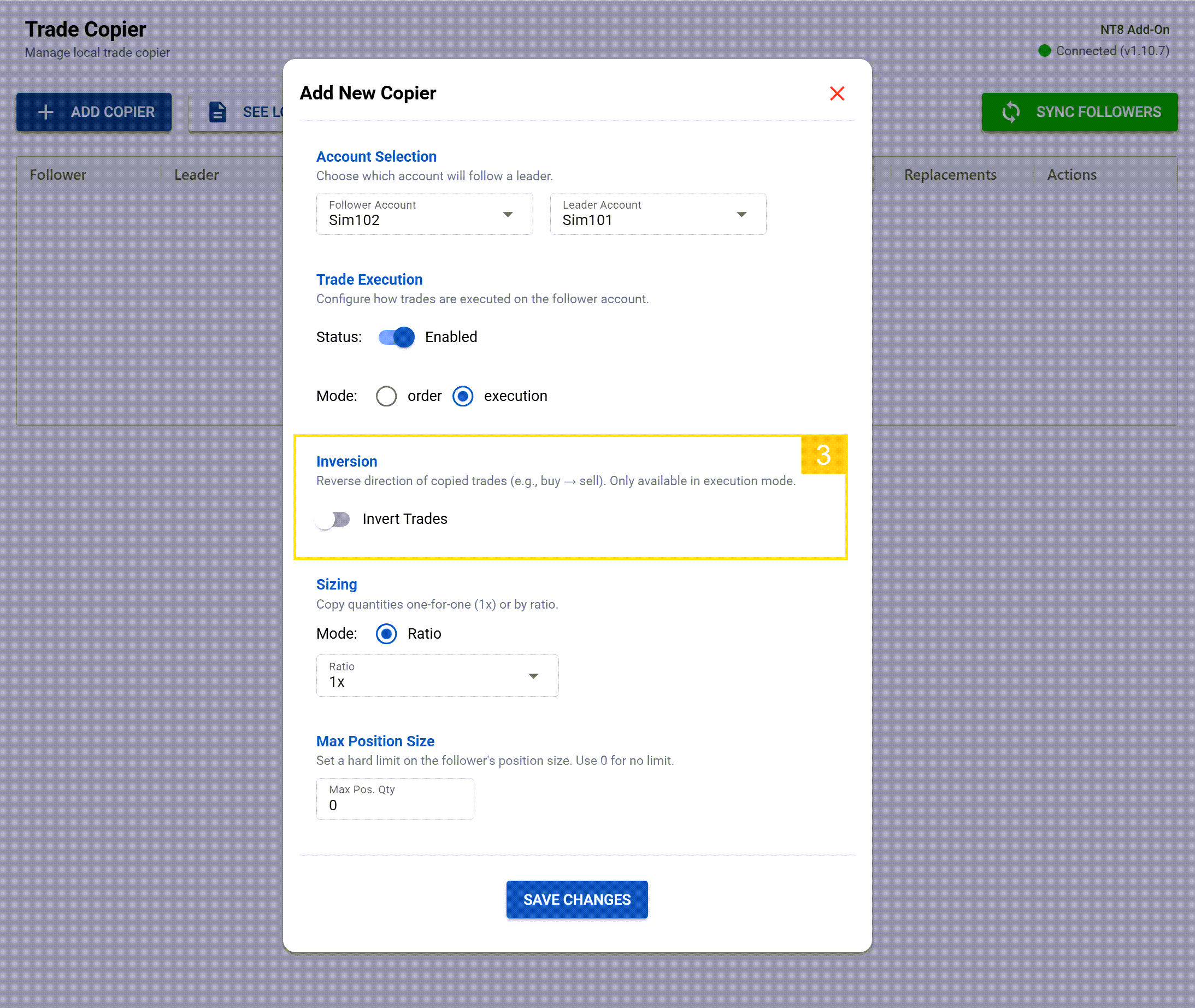

Trade Inversion: Automatic Hedging

Here's something really cool—trade inversion. You can now set a follower to trade in the opposite direction as the leader! This creates an instant hedge across your accounts.

This is incredibly powerful for risk management. You can run your main strategy normally on one account while automatically creating an inverse position on another, giving you built-in portfolio hedging without any manual intervention.

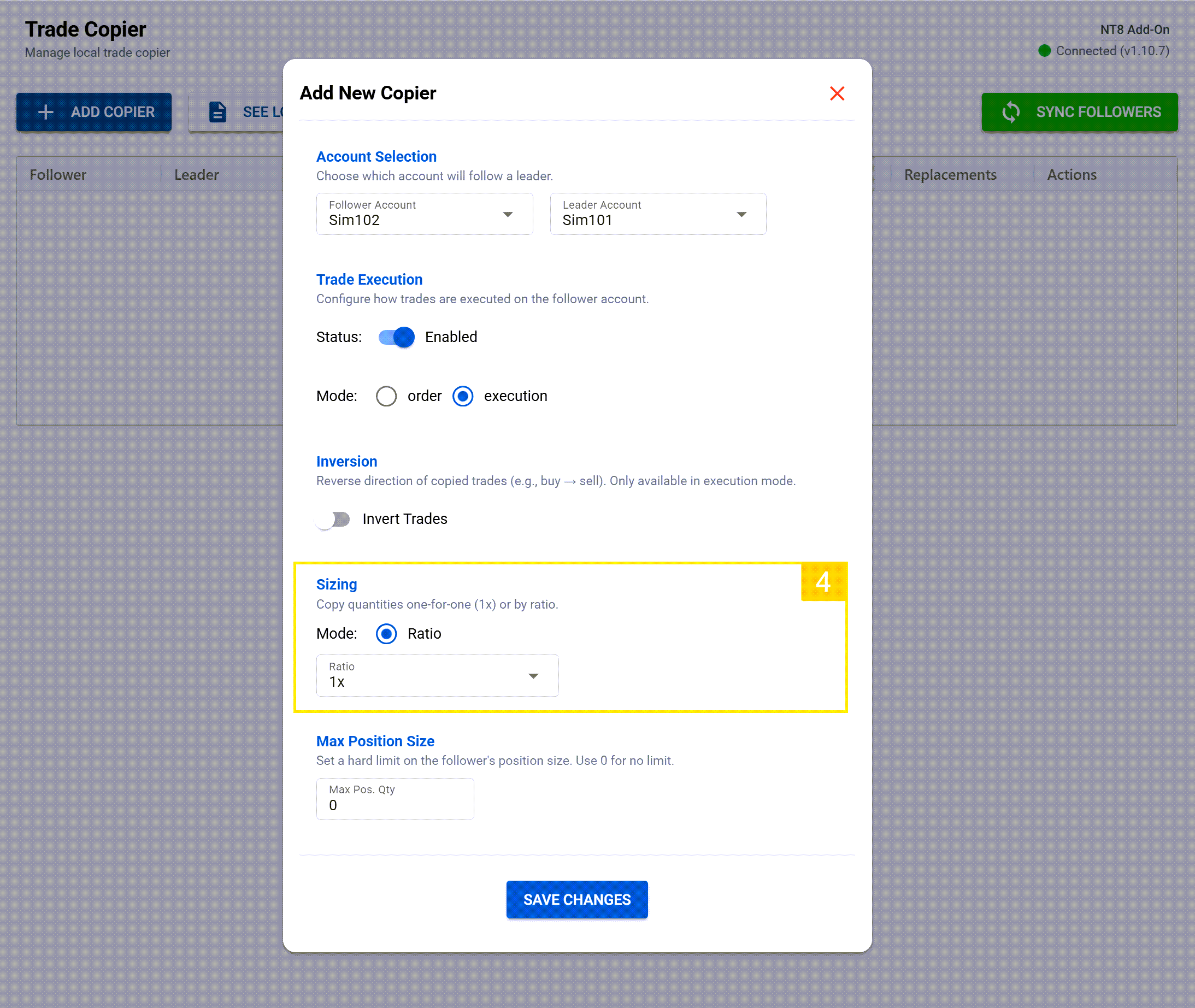

Flexible Position Sizing

Position sizing is completely customizable. Here I can set the follower to trade a fixed ratio—let's say 0.5x the source position size. So when my main account trades 4 contracts, the follower will trade 2.

This is perfect when you're copying from a large account to smaller prop firm challenges.

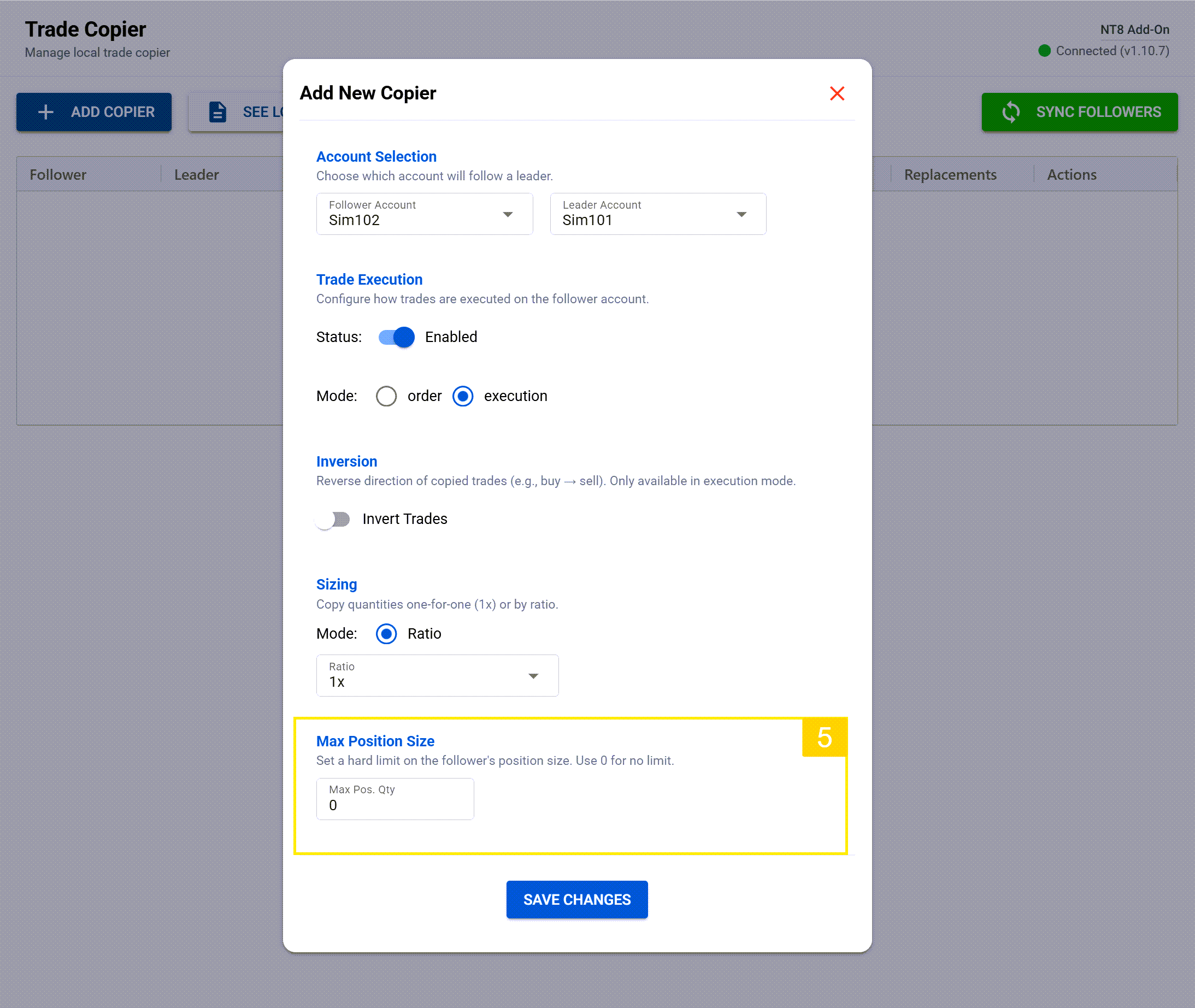

And of course, there's risk management built in. I can set a maximum position size per follower, so even if my main account goes crazy and trades 20 contracts, the follower will never exceed my preset limit.

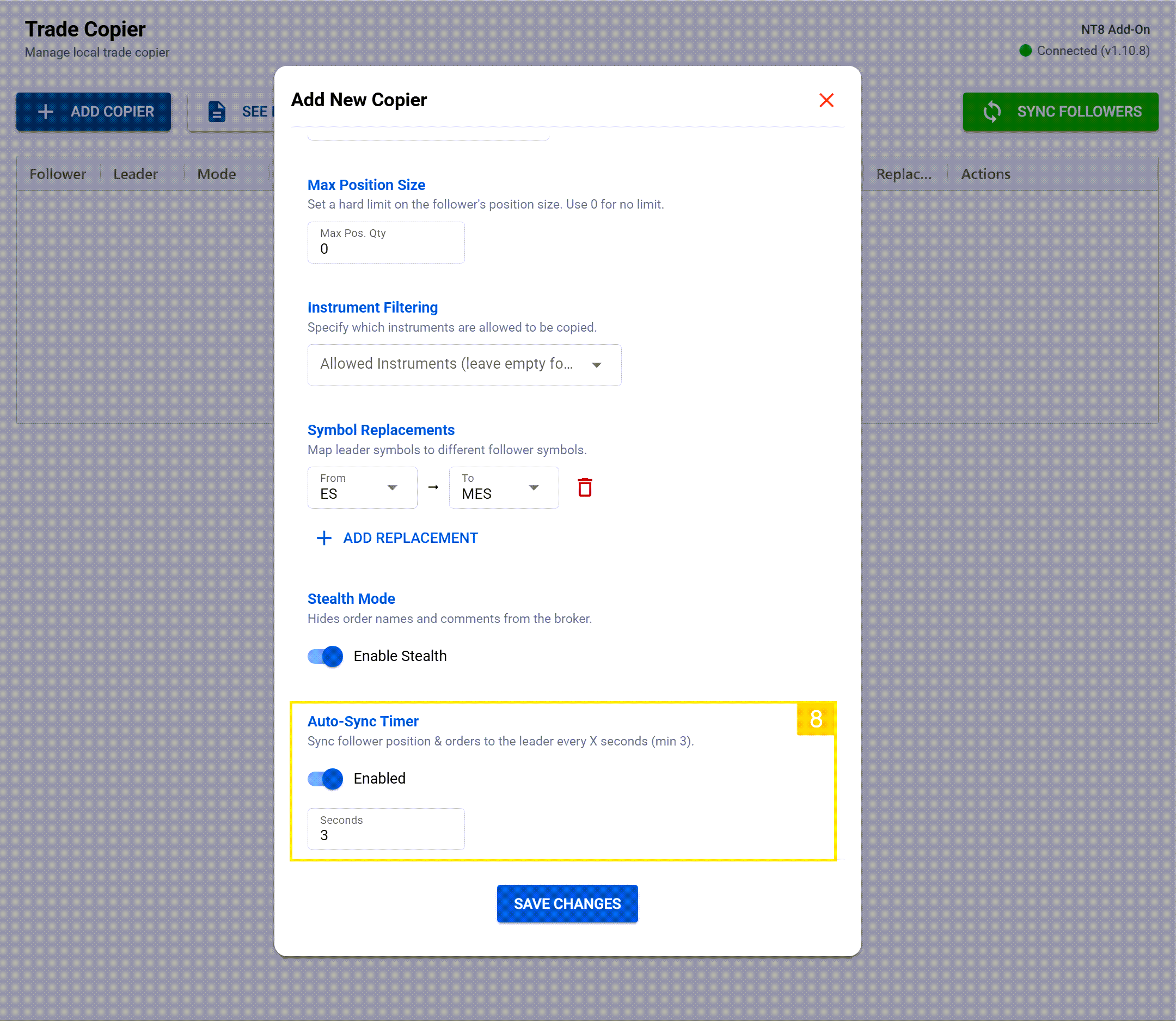

Advanced Filtering Options

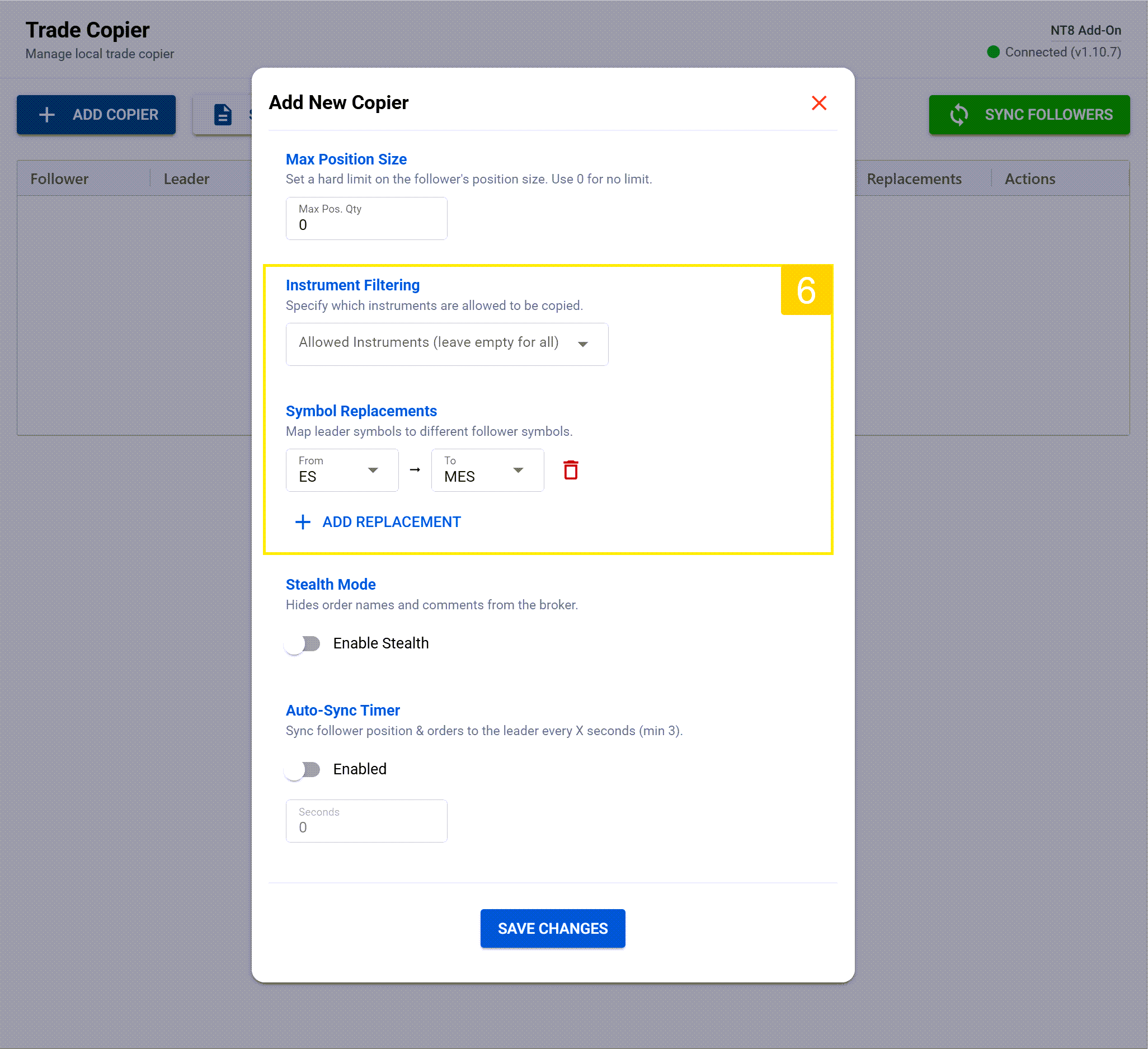

The filtering system is incredibly sophisticated. Let me show you instrument filtering first. I can configure this copier to only copy trades for specific instruments—say, just ES and NQ. Even if my source account trades oil, gold, or currencies, only the ES and NQ trades will be copied to this follower.

But here's where it gets really interesting—symbol replacement. You can set up the copier so that when the source account trades ES for example, the follower automatically trades MES instead. Same strategy, but sized appropriately for the follower account. The system maintains all the proper contract relationships automatically.

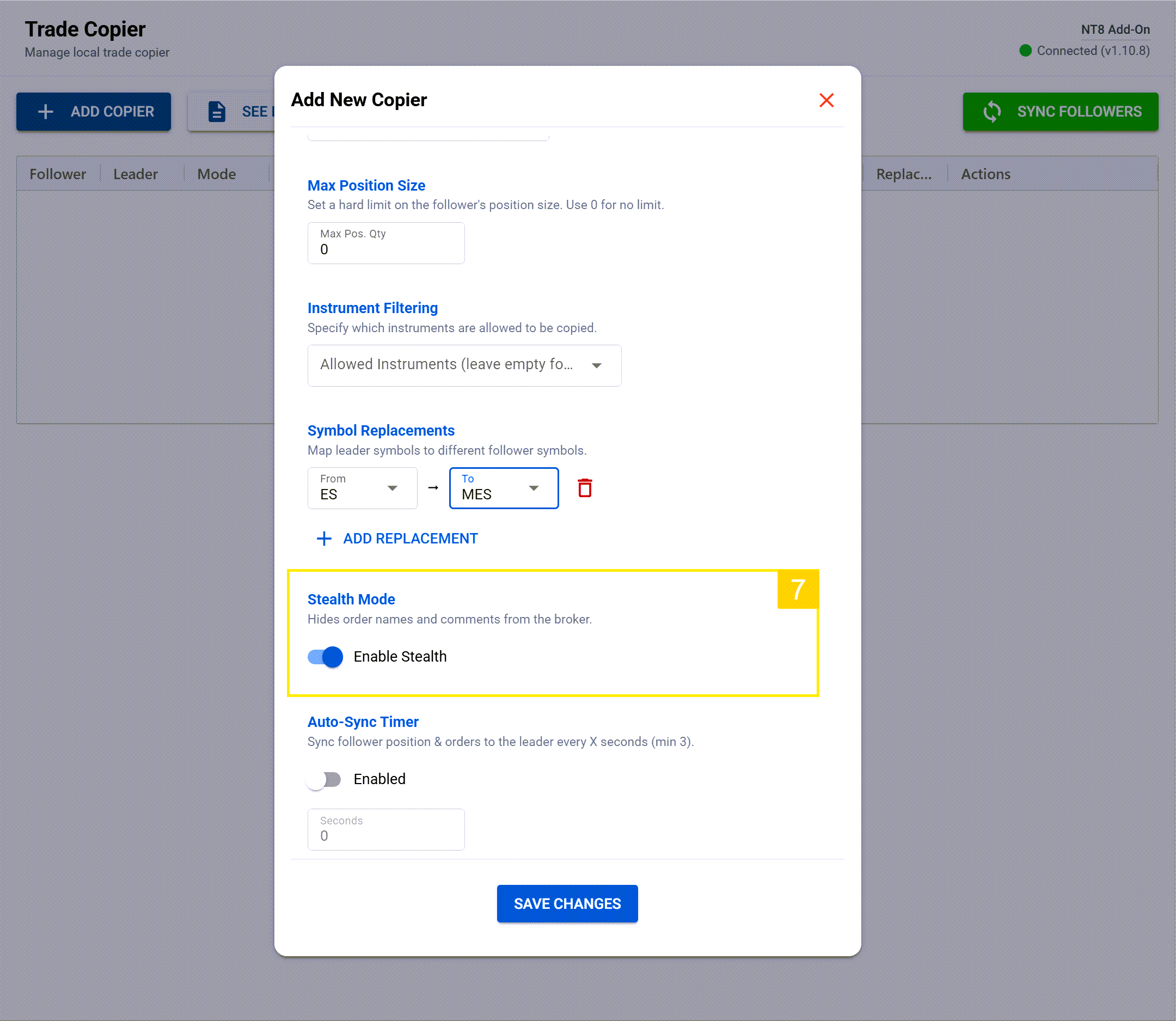

Stealth Mode

Stealth Mode completely hides any trace of automation from your broker. The copied trades look exactly like manual entries—same order flow, same timing characteristics, same naming conventions; no automation signatures whatsoever.

The best part? Stealth mode can recover its order mapping even after a catastrophic NT8 failure like connection loss or even a full restart of the software. How many trade copiers can say that?

Auto-Sync Timer

This is a game-changer. This feature is unique only to the CrossTrade copier and is a radically different approach to trade copier architecture.

Instead of worrying about edge case behaviors, clicking multiple check-boxes for what do do when weird stuff happens (partial fills, missed copy signals, etc.), we came up with something better: Auto-Sync.

Auto-Sync is a timer that executes at an interval and checks whether or not the follower accounts needs to be "realigned" to the leader account. If adjustments need to be made, CrossTrade will "fix" the follower to be match the leader, based on the copier config!

That means if you mistakenly closed a position in the follower that's supposed to be a 5x inverted ratio of the leader, or closed a bracket in order mode in the wrong account by mistake, don't worry about it! You're covered. Auto-Sync is a real insurance plan that won't ever deny you coverage.

By default, Auto-Sync is enabled and set to the minimum threshold of 3 seconds. This means that every 3 seconds your copier is constantly ensuring the follower matches the leader, preventing scenarios where things get out of alignment.

In the event of a connection loss, Auto-Sync will resume state synchronization immediately upon reconnection.

For those time when you need manual control, we also added a big green Sync Followers button on the main UI. If you made some changes and want to immediately get back in sync, its a click away (or 3 seconds). Or if you turn Auto-Sync off, the green button is there when you need it.

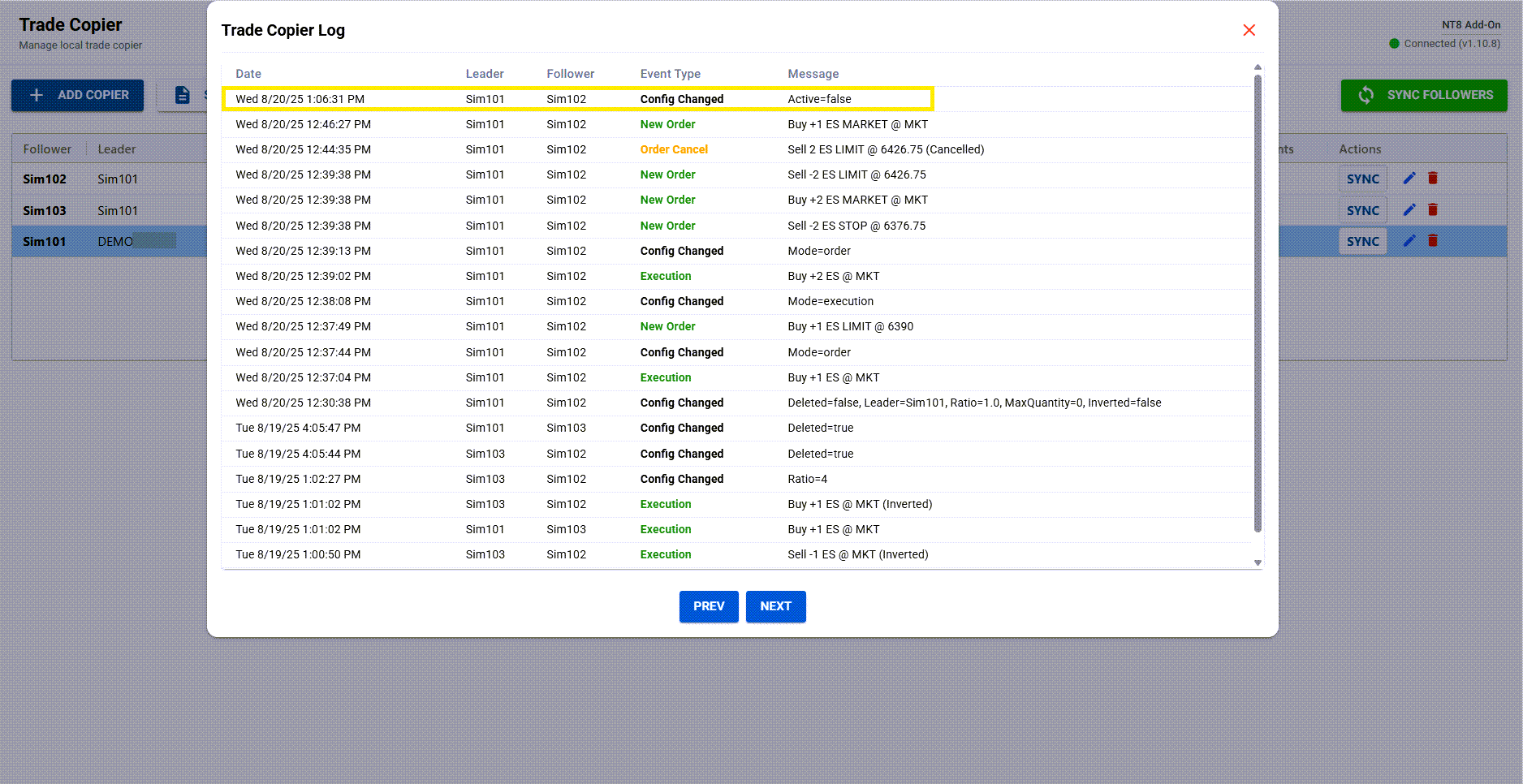

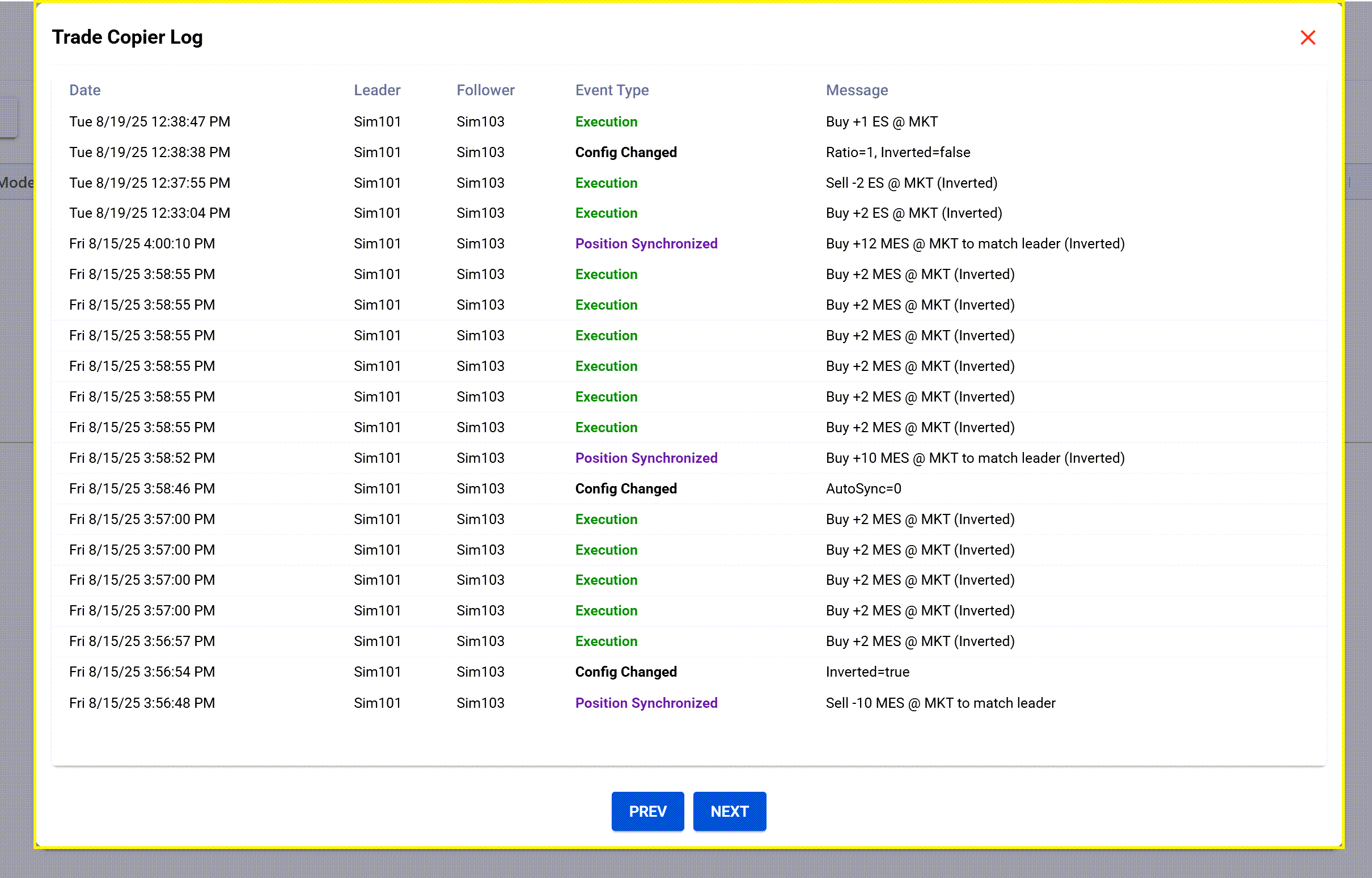

Copier Logs

Similar to the Alert History page in your CrossTrade account, we also included a full Logging system to track and record all execution actions and config changes. Now you can rest easy knowing that you'll have a place to look back at if you find yourself troubleshooting.

Video Overview

Coming Very Soon

We're putting the finishing touches on the Trade Copier right now. It's going through final testing, and we expect to release it in public beta within the next few weeks. Once it's live, it'll be included by default in our Pro plan.

This represents months of development work focused on solving real problems that prop traders and multi-account operators face every day. We've built it to be bulletproof, flexible, and powerful enough to handle the most demanding trading operations.

If you're currently managing multiple accounts manually or using inferior copying solutions, the Trade Copier is going to completely transform your workflow. Stay tuned—we'll announce the official release as soon as testing is complete.

Want to be notified when the Trade Copier launches? Join our Discord community for the latest updates.