Introducing Tick and Percentage Support for Limit, Stop, Take Profit, and Stop Loss

Our latest CrossTrade update allows traders to set stop loss and take profit levels using ticks or percentages like "25 ticks" or "1.5%". CrossTrade auto-rounds values to the nearest tick for accurate execution, making strategy setup easier and more precise.

We’re thrilled to introduce more flexibility to your trading strategies with our latest CrossTrade update! You can now set stop loss, stop price, limit, and take profit levels using both tick and percentage values, making your risk management more precise and tailored to your needs.

Whether you want to specify 25 ticks, 1.5%, or even 1.53948%, CrossTrade will automatically calculated and rounds to the nearest tick and set your price.

How Does It Work?

This new functionality allows you to use any combination of the following for take_profit, stop_loss, limit_price, or stop_price:

- Ticks: Values like "25 ticks" or "25ticks" will be processed without issue.

- Percentages: Use positive or negative percentages, such as "1.5%", "+1.5%", or "-2.5943%", to reflect the market direction in your strategy.

When using tick or percentage values, CrossTrade automatically translates them into precise price levels by using the real-time market data from your NinjaTrader 8 feed. It calculates the target price based on the most recent quote and sends the converted price to NinjaTrader, rounded to the nearest tick size as needed.

The underlying logic ensures that your orders are accurate without requiring manual recalculation. For instance, if you specify a take profit at "+2.5%" above the current market price, CrossTrade uses your NT8 feed to determine the current market price, calculates 2.5% above it, and then submits that price directly as your take profit level.

Examples of How You Can Use This Feature

Set a take profit at 2.5% above the current market price while simultaneously setting a stop loss at -5% below the market level. This can be especially useful for volatile instruments where the price moves quickly, and having dynamic levels ensures you adjust effectively to market conditions.

key=your-secret-key;

command=PLACE;

account=sim101;

instrument=NQ 12-24;

action=BUY;

qty=1;

order_type=MARKET;

TIF=DAY;

take_profit=2.5%;

stop_loss=-5%;TP/SL order using % above/below spot price

This command sets an OCO (One-Cancels-the-Other) bracket order to take profit at 2.5% above the underlying price and stop loss at 5% below the price.

Similarly, a limit order can be set:

key=your-secret-key;

command=PLACE;

account=sim101;

instrument=ES 12-24;

action=BUY;

qty=1;

order_type=LIMIT;

TIF=DAY;

limit_price=-15 ticks;Limit price set as ticks below spot price

In this example, we configure a buy limit order is placed 15 ticks below the current price, allowing you to catch slight pullbacks and optimize your entry points. The order will fill once the current underlying price drops 15 ticks from its current position.

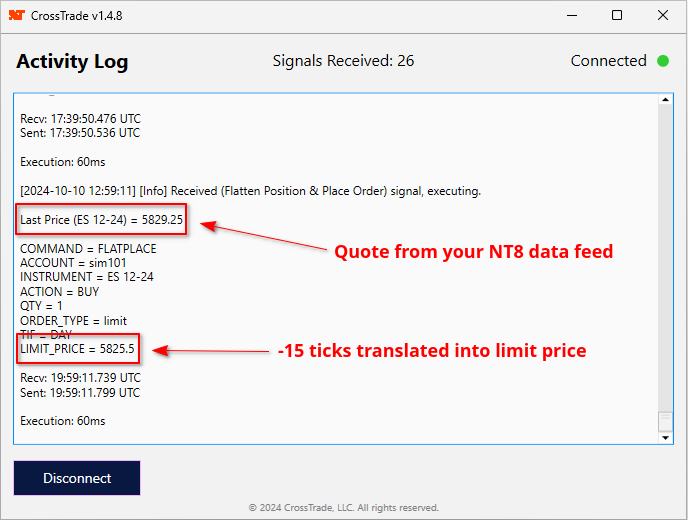

Before CrossTrade executes the order, it first requests a quote from your own NT8 data feed, then uses the last price and tick size of the underlying to translate your request into a price level for the limit order.

When CrossTrade makes a quote request, you can see the "last" price quoted from your NT8 data feed that was used to calculate the price level.

Why This Matters for Your Trading

By offering tick and percentage-based stop-loss and take-profit options, CrossTrade provides a more adaptive trading environment. Whether you're trading highly volatile assets like cryptocurrencies or more stable futures contracts, you can now set risk parameters that align with your unique trading style.

This release aims to simplify your trading setup while maintaining the accuracy you need. No more manual price calculations or guesswork—simply set your limits in the way that makes the most sense for your strategy and let CrossTrade handle the rest.

We can’t wait for you to try it out—happy trading with CrossTrade!