NKE Misses the Basket on Earnings

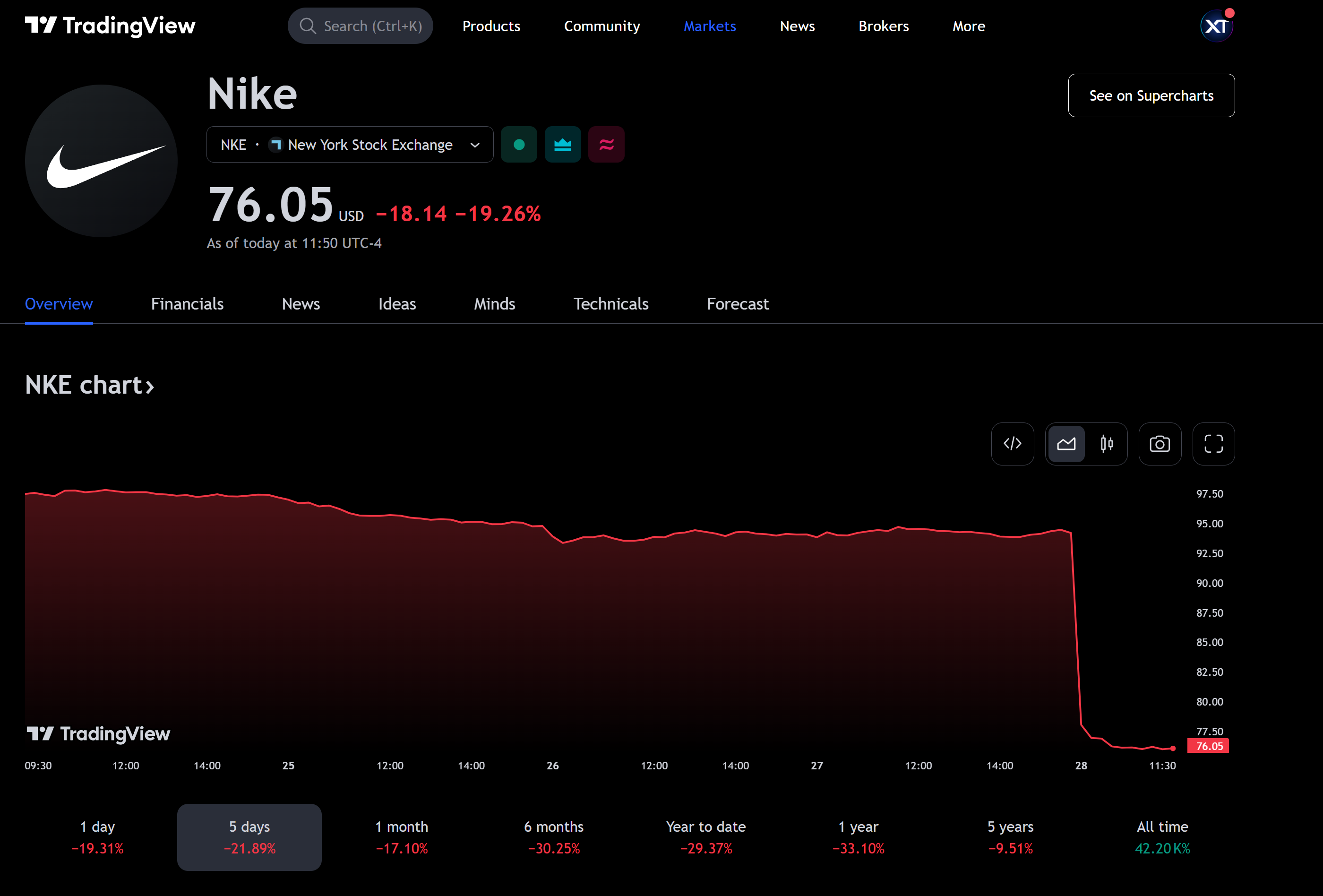

Nike misses earnings with terrible 2025 guidance, causing the stock to open down almost 20%

Shares of Nike saw a significant drop on Friday, June 28th, after the company revised its full-year outlook, predicting a 10% decline in sales for the current quarter due to weak performance in China and "uneven" consumer trends worldwide.

Nike's earnings report for the fourth quarter of 2024 missed analysts' revenue expectations, coming in at $12.6 billion, which was slightly below the expected $12.91 billion. However, the company managed to beat earnings per share (EPS) estimates, reporting $0.99 per share, which was higher than the $0.84 expected by analysts. Despite the revenue miss, Nike's full-year revenue for 2024 increased by 1% to $51.4 billion from the previous year's $51.2 billion. The company's stock experienced a significant drop of 14% in premarket trading following the earnings announcement.

As of mid-day trading on Friday, NKE was down nearly 20%.

But hey, it's not all bad news for the Swoosh. Their earnings per share (EPS) actually beat expectations, coming in at $0.99, a full 15 cents higher than the $0.84 expected by analysts.

Nike's CFO, Matt Friend, mentioned that the company is facing some challenges that led to the updated fiscal 2025 guidance.

"We are driving better balance across our portfolio. While we are encouraged by our progress, our fourth quarter results highlighted challenges that have lead us to update our Fiscal '25 outlook"

Previously, Nike had expected sales to rise. The company also projects a high single-digit decline in sales for the first half, versus prior guidance of low single-digit decreases.

"A recovery of this magnitude takes time," Friend stated during a call with analysts on Thursday. "Although the upcoming quarters will be challenging, we are confident in repositioning Nike for better competitiveness with a balanced portfolio to drive sustainable, profitable, long-term growth."

The company lowered its projections due to slower online sales, planned reductions in classic footwear lines, "increased macro uncertainty" in Greater China, and "uneven consumer trends" across various markets, according to Friend. Additionally, sales to wholesalers are expected to slow as Nike focuses on scaling new innovations and reducing classic lines.

For the fiscal fourth quarter, Nike surpassed earnings expectations due to ongoing cost-cutting measures, but it fell short on revenue.

Here's how Nike performed in comparison to Wall Street expectations, based on LSEG analyst surveys:

- Earnings per share: $1.01 adjusted vs. 83 cents expected

- Revenue: $12.61 billion vs. $12.84 billion expected

For the three months ending May 31, Nike reported a net income of $1.5 billion, or 99 cents per share, compared to $1.03 billion, or 66 cents per share, a year earlier. Sales decreased to $12.61 billion, down about 2% from $12.83 billion the previous year.

In fiscal 2024, Nike reported sales of $51.36 billion, matching the prior year's figures. This represents the slowest annual sales growth for the company since 2010, excluding the pandemic period.

Nike executives attributed the sales shortfall to several factors. They noted a decline in the lifestyle segment and insufficient momentum in performance categories like basketball and running shoes to compensate.

Online sales were weak due to a higher proportion of lifestyle products, more promotions, and fewer sales of classic franchises like the Air Force 1. Additionally, traffic in China declined across all channels starting in April due to macroeconomic conditions.

Despite the decline in traffic, sales in China exceeded Wall Street expectations, reaching $1.86 billion compared to estimates of $1.79 billion, according to Street. Account. China was the only geographical segment to exceed estimates for the period.

Sales in North America, Nike's largest market, totaled $5.28 billion, falling short of expectations of $5.45 billion.

In Europe, the Middle East, and Africa, Nike reported revenue of $3.29 billion, versus estimates of $3.32 billion. In Asia Pacific and Latin America, sales were $1.71 billion, compared to expectations of $1.77 billion.

Friend later cautioned about a "softer outlook" in China, noting that sales would have missed Nike’s internal expectations if not for Tmall's early start to the 618 shopping holiday.

"The China marketplace remains highly promotional, and we continue to manage inventory carefully for both Nike and our partners," Friend said. "While our near-term outlook has softened, we remain confident in Nike’s competitive position in China long term."

Nike's Converse brand significantly underperformed, with revenue dropping 18% to $480 million, mainly due to declines in North America and Western Europe.

In recent months, Nike, a longstanding leader in the sneaker and athletic apparel industry, has struggled to stay ahead of new competitors. Its revenue growth has slowed, it has faced criticism for lagging in innovation, and it has started to reverse its direct-sales strategy, which did not yield the expected results.

Under this strategy shift, Nike had been pushing sales through its own website and stores rather than through wholesalers like Foot Locker. However, it has recently begun reversing this initiative, acknowledging it went too far in distancing itself from wholesalers.

This strategy can be more profitable and provides better brand and customer data control, but it can also lead to logistical challenges and unexpected costs.

During the quarter, Nike’s direct revenues were $5.1 billion, an 8% decline compared to the previous year. Meanwhile, wholesale revenue rose 5% to $7.1 billion, reflecting Nike’s shift away from direct selling.

Nike has announced plans to reduce the number of products on the market in favor of new innovations, betting that new styles and the 2024 Paris Olympics will help the company regain solid footing.

CEO John Donahoe said during a conference call that Nike was speeding up plans to reduce the supply of classic franchises due to poor online performance, which is expected to impact fiscal 2025 revenue.

"We are addressing our near-term challenges head-on while making progress in critical areas for Nike’s future—performance innovation, consumer pace, and marketplace growth," Donahoe said. "I’m confident our teams are leveraging our competitive advantages to create greater impact for our business."