Take Profit Trader: A Deep Dive Into the Game-Changing Futures Prop Firm

Discover how Take Profit Trader's single-step evaluation and NinjaTrader 8 integration make futures prop trading accessible. Get 40% off and start your funded trading journey today.

The proprietary trading landscape has evolved dramatically over the past few years, with new firms emerging to challenge traditional approaches to funded trading. Among these innovators, Take Profit Trader (TPT) has carved out a distinctive niche, particularly for futures traders seeking a more straightforward path to funded accounts.

The Origin Story: From Ice Rink to Trading Floor

Take Profit Trader's foundation story is as unique as its approach to prop trading. The company was founded in 2022 by James Sixsmith, whose journey from professional hockey player to trading entrepreneur offers valuable insights into the mindset required for both athletic and financial success.

After earning his economics degree from the College of the Holy Cross, Sixsmith pursued a professional hockey career that took him through North American minor leagues and eventually to European teams. However, earning just $28,000 annually while sustaining multiple injuries made it clear that hockey wouldn't provide long-term financial security.

During his playing years, Sixsmith began exploring trading as a potential career transition. Like many newcomers to the markets, he experienced significant early losses, dropping nearly $150,000 while learning the ropes. This painful education became the foundation for his later success and, ultimately, his mission to help other traders avoid similar pitfalls.

The transition from athlete to trader wasn't accidental. Sixsmith recognized that many of the psychological traits that made successful athletes also translated well to trading: discipline, the ability to handle pressure, and perhaps most importantly, the grit to persist through inevitable setbacks.

Building the Foundation: From Trade Context to Take Profit Trader

Before launching Take Profit Trader, Sixsmith founded Trade Context in 2015, a company focused on trading education and third-party funding connections. Through Trade Context, he provided over $7 million to aspiring traders and helped thousands more through educational seminars.

The evolution from Trade Context to Take Profit Trader represented a strategic shift toward vertical integration. Rather than relying on third-party funding partners, Sixsmith wanted to control the entire trader development process in-house. This decision would prove crucial in creating TPT's streamlined approach to trader funding. Learn more about TPT's current offerings and how they compare to other prop firms.

The Take Profit Trader Model: Simplicity as a Competitive Advantage

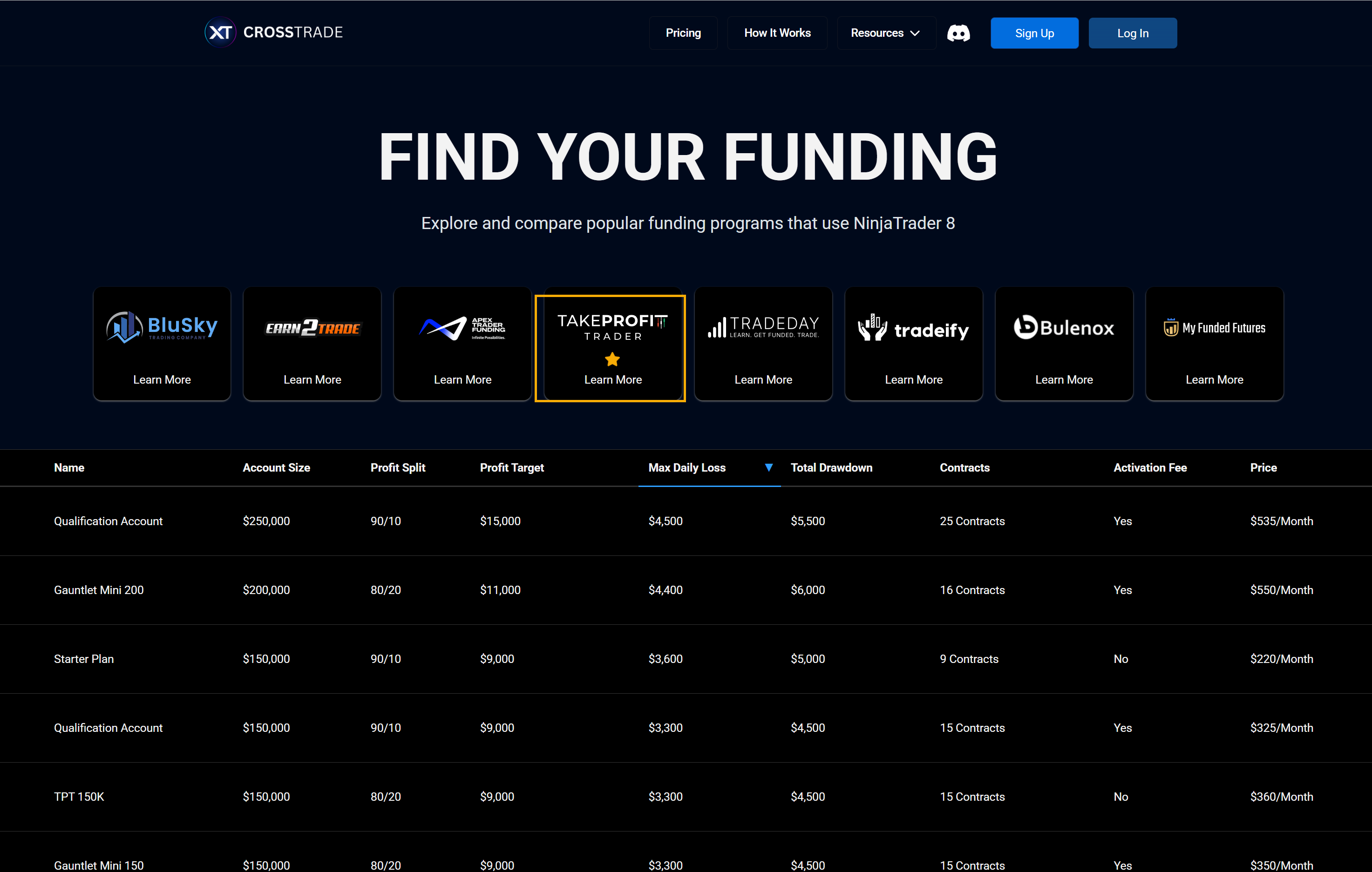

What sets Take Profit Trader apart in the crowded prop trading space is its commitment to simplicity. While many competitors have adopted complex multi-step evaluation processes, TPT operates with a single-step evaluation that focuses on essential trading metrics without unnecessary complications. Compare TPT with other leading prop firms to see how their approach differs from the competition.

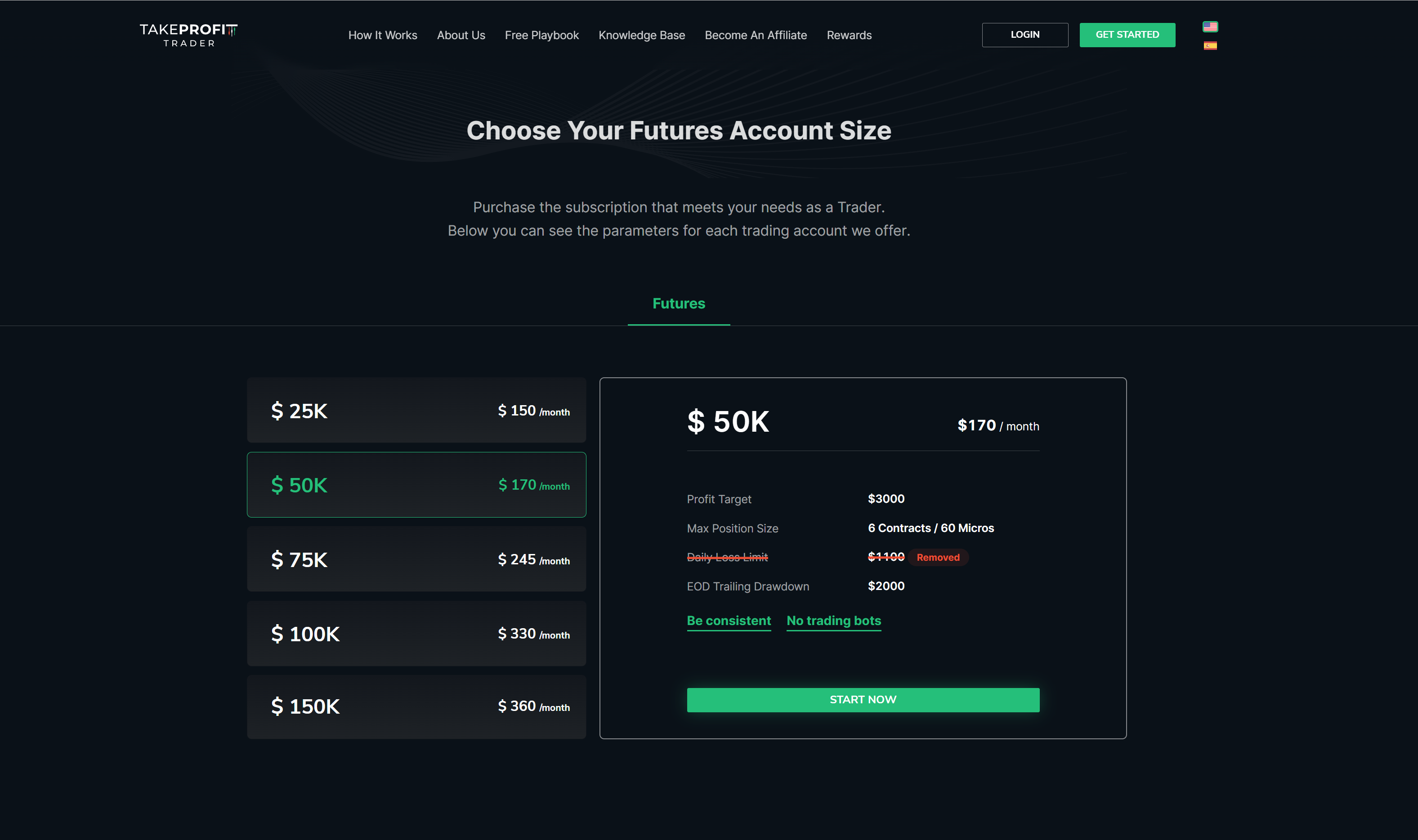

Account Structure and Pricing

Take Profit Trader offers five account sizes ranging from $25,000 to $150,000, with corresponding monthly subscription fees between $150 and $360. The pricing structure reflects the firm's understanding that traders need options that match their skill level and risk tolerance.

What makes TPT's pricing particularly attractive is the transition from subscription-based evaluation accounts to funded PRO accounts. Once traders successfully complete their evaluation, they pay a one-time activation fee of $130 (regardless of account size) and eliminate recurring monthly charges. This structure can result in significant long-term savings compared to firms that continue charging monthly fees even after funding.

NinjaTrader 8: The Platform of Choice

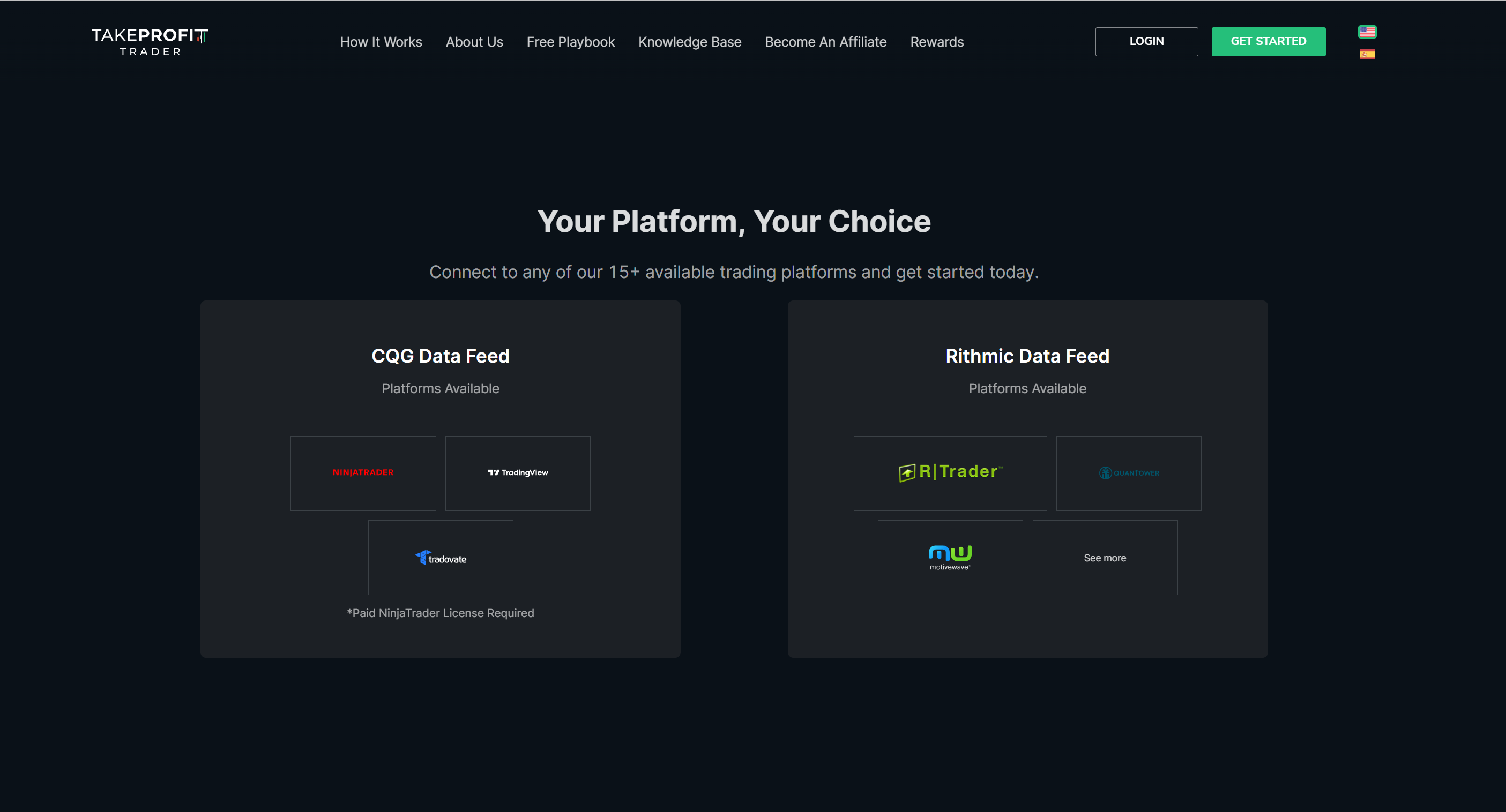

Take Profit Trader centers their trading infrastructure around NinjaTrader 8, the industry-leading futures trading platform known for its advanced charting capabilities, comprehensive analytical tools, and robust order management system. NinjaTrader 8's institutional-grade features provide traders with everything needed for professional futures trading, from sophisticated technical analysis to automated strategy development.

The platform's advanced charting package includes hundreds of built-in indicators, drawing tools, and customizable workspaces that allow traders to create personalized trading environments. NinjaTrader 8's Market Analyzer provides real-time scanning capabilities, while the Strategy Builder enables traders to develop and backtest automated trading systems without programming knowledge.

While TPT also supports other platforms like TradingView, Tradovate, and Quantower for traders with specific preferences, NinjaTrader 8 remains the primary focus due to its comprehensive feature set and proven reliability in professional trading environments.

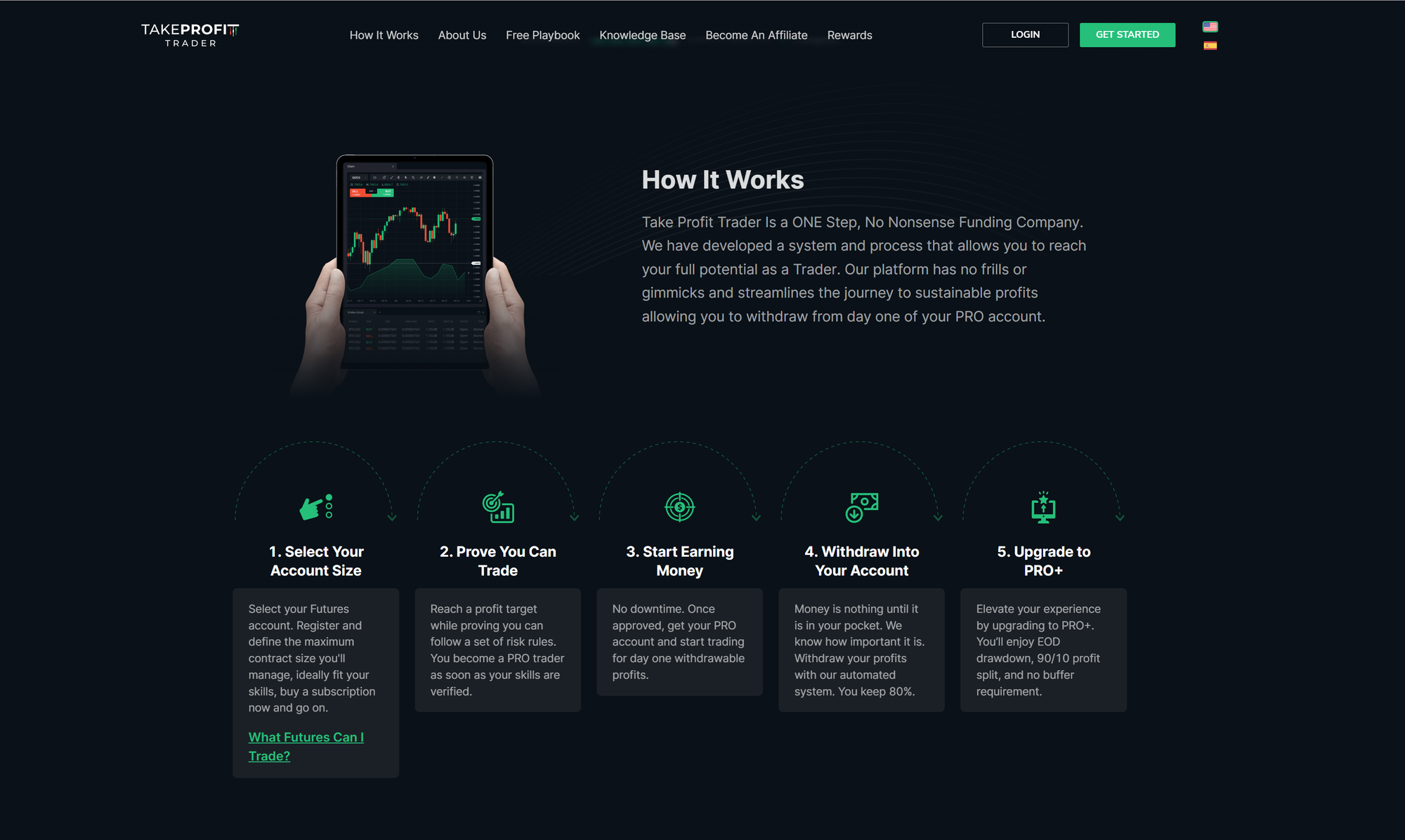

The Evaluation Process: One Step to Funding

TPT's single-step evaluation process requires traders to achieve a 6% profit target while adhering to risk management rules. The specific requirements vary by account size, with profit targets ranging from $1,500 for the $25,000 account to $9,000 for the $150,000 account.

The evaluation accounts operate with end-of-day trailing drawdowns, meaning traders won't be eliminated by intraday fluctuations. This rule structure acknowledges that successful trading often involves temporary unrealized losses before profitable positions develop.

Importantly, TPT removed the maximum daily loss limit in January 2025, further simplifying the evaluation process. This change reflects the firm's ongoing commitment to reducing unnecessary complexity while maintaining essential risk management protections.

The Funding Experience: Where TPT Truly Differentiates

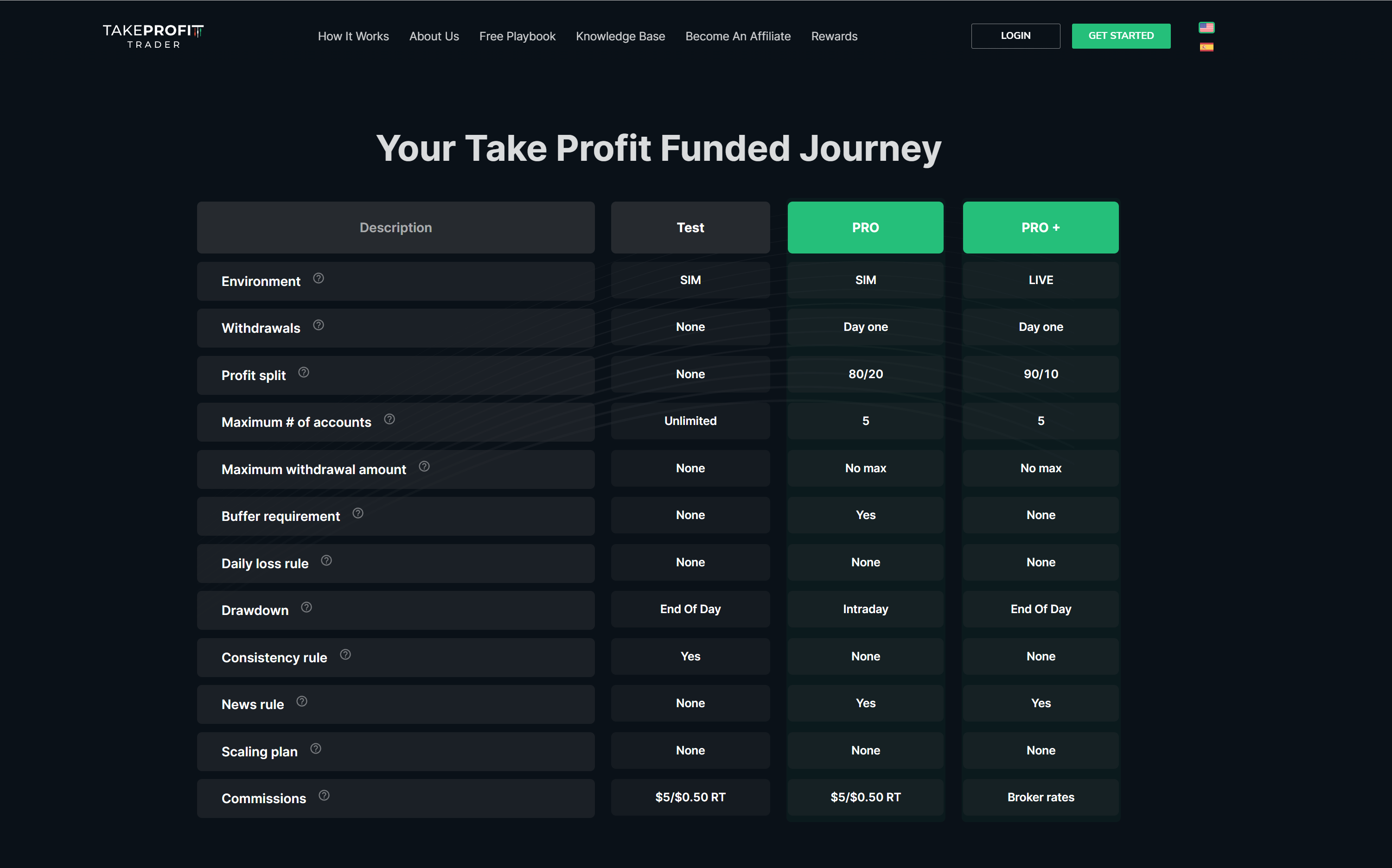

The transition from evaluation to funded trading is where Take Profit Trader's value proposition becomes most apparent. Upon successful evaluation completion, traders receive PRO accounts that offer several key advantages:

Immediate Profit Access

Unlike many competitors who impose waiting periods or minimum trading day requirements, TPT allows traders to request withdrawals from day one of their PRO account. This policy addresses one of the most common frustrations among prop traders: having to wait extended periods to access earned profits.

Profit Sharing Structure

PRO accounts offer an 80/20 profit split favoring the trader. After 60 days of successful trading, accounts can be upgraded to PRO+ status, which increases the profit split to 90/10. This progression structure rewards consistent performance while providing immediate value to newly funded traders.

Account Scaling and Reset Options

Traders can manage up to five PRO or PRO+ accounts simultaneously, allowing for strategy diversification or simply increased earning potential. If a funded account experiences significant losses, traders can reset it up to three times rather than returning to the evaluation process.

Live Market Transition

PRO+ accounts represent a significant advantage in the prop trading space. These accounts involve actual live market trading through regulated brokers like Tradovate, rather than simulated environments. This transition provides traders with the psychological benefits of knowing their trades are actually impacting real markets.

Risk Management and Customer Support

Take Profit Trader's risk management approach balances trader freedom with necessary protections. The firm uses regulated brokers and CME-approved data providers to ensure that all trades are executed in genuine market conditions. View TPT's official company information to verify their regulatory compliance.

One area where Take Profit Trader consistently receives positive feedback is customer support. The firm offers 24/5 live chat support staffed by actual people rather than automated systems. This approach reflects the founder's belief that personalized service is becoming increasingly rare in the digital age.

Market Position and Reputation

Take Profit Trader has built a strong reputation in the prop trading community, evidenced by over 4,500 reviews on Trustpilot with an average rating of 4.3 out of 5 stars. The firm's approach to addressing negative feedback by engaging directly with affected traders demonstrates a commitment to continuous improvement.

The company's transparency about its processes and rules has helped build trust within the trading community. Unlike some competitors who use complex terms and conditions to create hidden barriers, TPT's straightforward approach makes it easier for traders to understand exactly what's expected of them.

Take Profit Trader's approach represents a broader trend toward democratizing access to trading capital. By removing many traditional barriers to entry while maintaining essential risk management protections, the firm makes serious trading accessible to individuals who might otherwise lack the necessary capital.

Getting Started with Take Profit Trader

For traders considering Take Profit Trader, the evaluation process provides a low-risk way to assess both the platform and their own trading abilities. The single-step evaluation, combined with NinjaTrader 8 integration and straightforward rules, makes the initial experience as smooth as possible.

Ready to explore what Take Profit Trader can offer? Use coupon code XT at checkout for 40% off your funded tryout.