New on TradingView: Portfolio Tracking Now Available

TradingView’s new Portfolios feature lets you track real trades, analyze performance, and uncover opportunities—all from actual transaction history, not just position snapshots.

TradingView has just launched a new feature designed to help traders and investors better manage and analyze their real-world portfolios. This update introduces Portfolios — a tool that lets users bring actual trading history onto the platform for deeper insights and performance tracking.

Whether you trade stocks, crypto, forex, or futures, Portfolios provides a way to go beyond simple position snapshots. Instead of just showing current holdings, it captures every transaction — buys, sells, deposits, and withdrawals — to help you understand how your portfolio got to where it is.

What You Can Do with TradingView Portfolios

Here’s a breakdown of what this new feature enables:

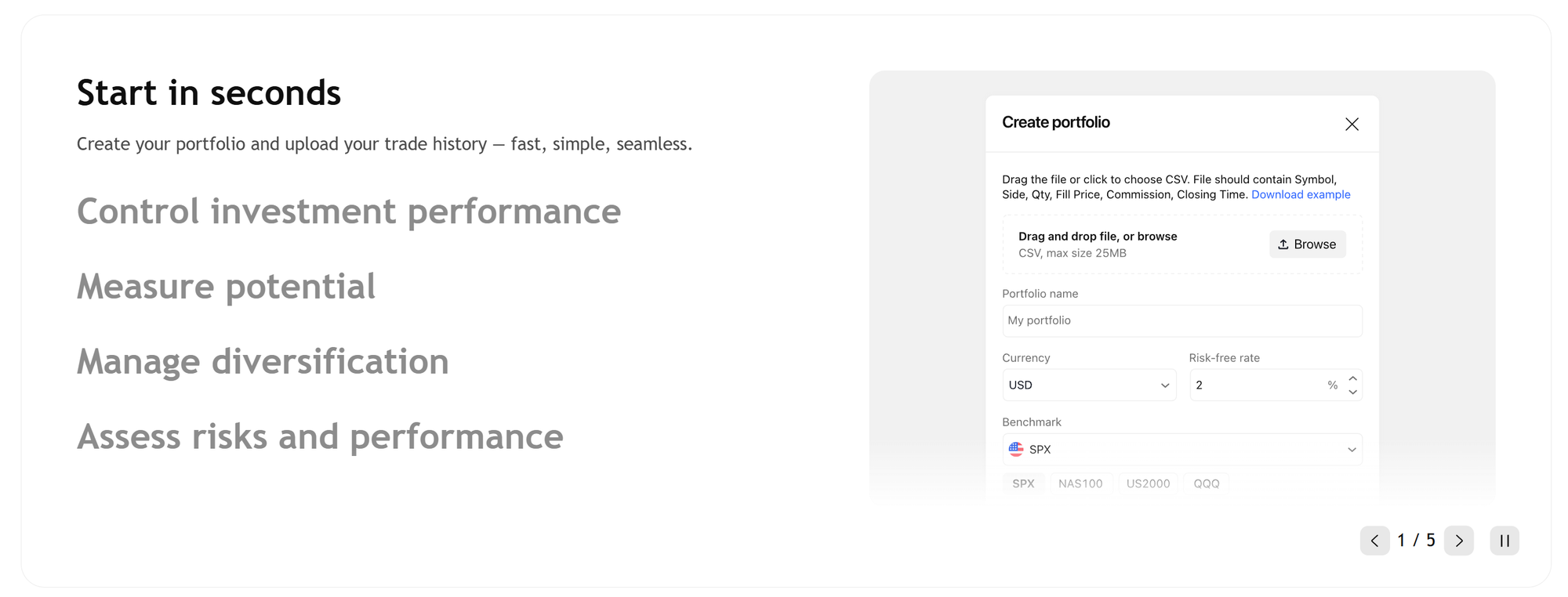

- Get started quickly – Users can upload trade histories or manually add transactions to build their portfolio in minutes.

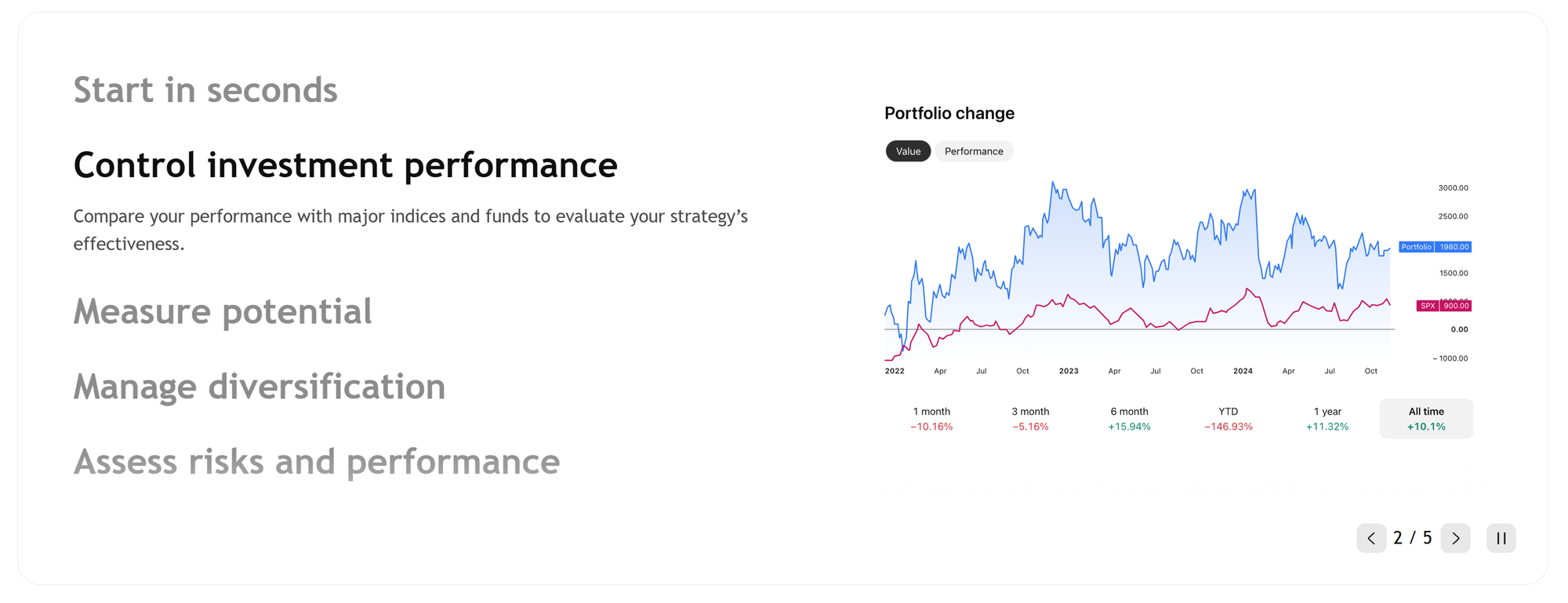

- Track real performance – Compare your returns against benchmarks like major indices or ETFs to evaluate your strategy’s effectiveness.

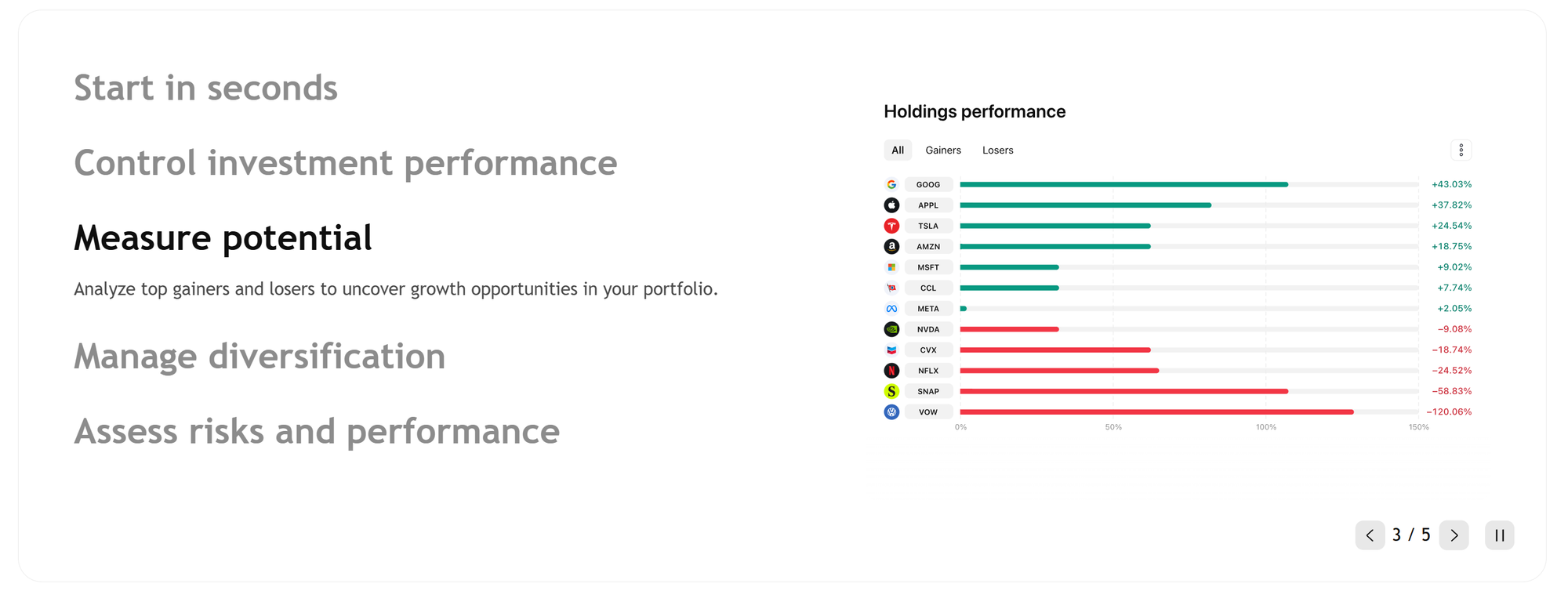

- Find what’s working – Identify your best and worst performers to uncover potential adjustments or opportunities.

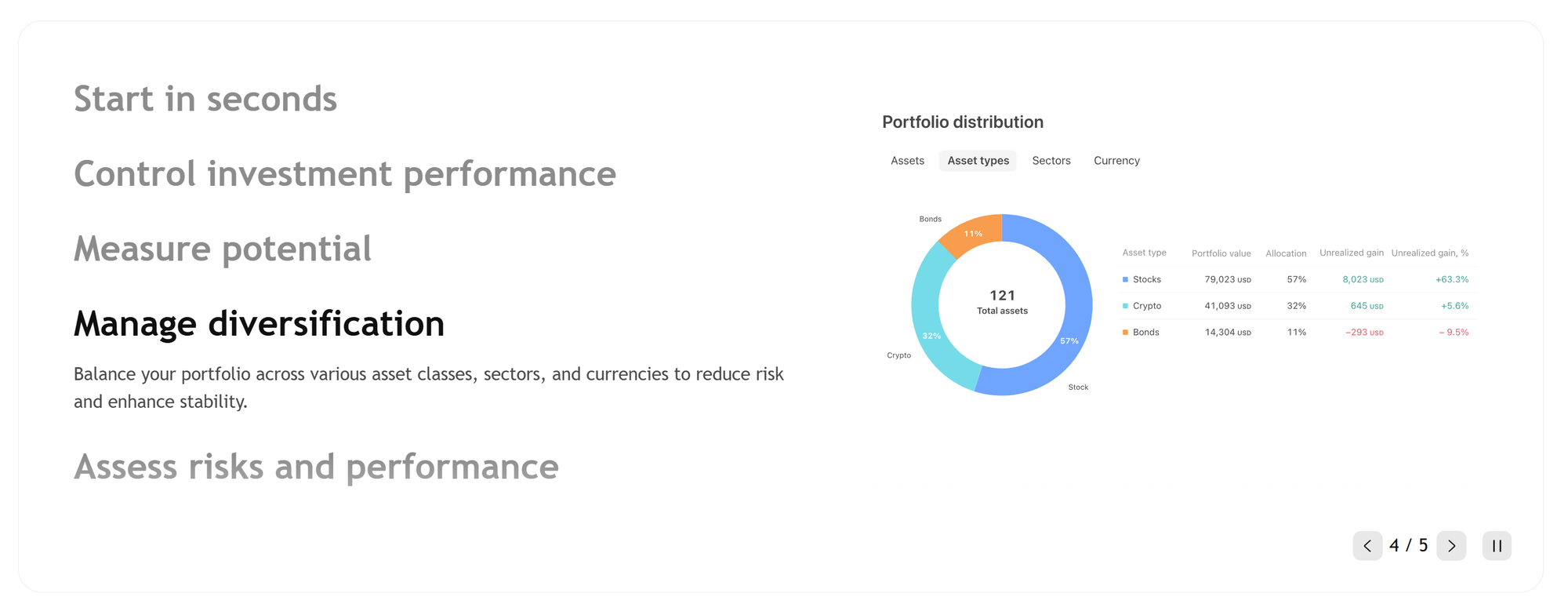

- Stay diversified – Analyze your portfolio by sector, asset class, or currency — and make informed decisions about rebalancing.

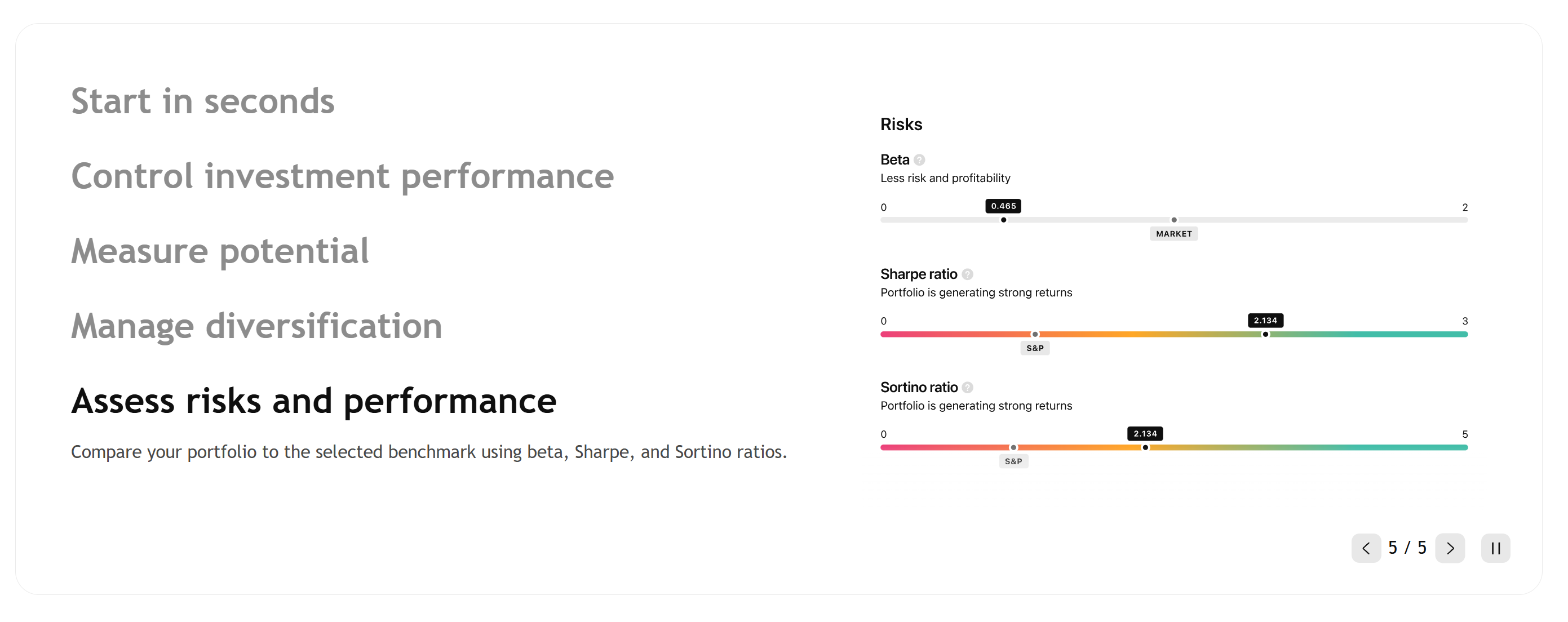

- Evaluate risk – Use advanced metrics like beta, Sharpe ratio, and Sortino ratio to assess how your portfolio behaves relative to the market.

The free version allows tracking up to 20 holdings and 2,000 transactions per portfolio. For those managing more complex strategies, TradingView’s paid tiers expand that to 50 holdings and 5,000 transactions across up to three portfolios.

This new addition gives TradingView users a solid framework to track and improve trading performance based on real, historical activity — a helpful step forward for both casual and active traders.